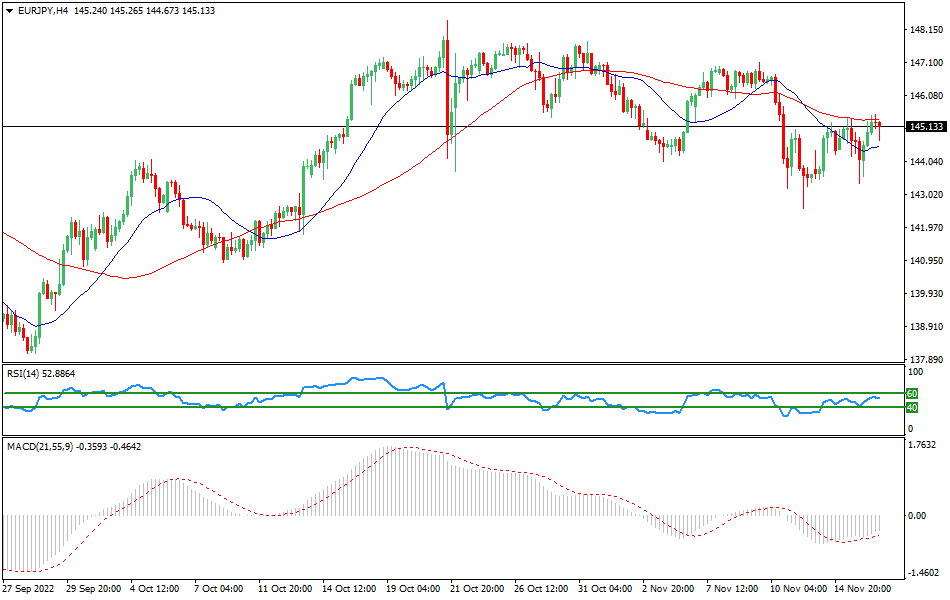

Technical analysis for the EUR/JPY currency pair

On the daily chart, there was a rebound to the resistance level of 145.65 (near the September high). The pair's recovery above the level of 144.30 makes the bearish picture less obvious, since 144.30 was the upper limit of the range from mid-October 144.30-147.35. The pair's recovery above this level can be considered as a return to the range from mid-October 144.30-147.35, in this case, a decline below 144.30 looks like a false breakdown down. As part of the movement in a narrower range, the growth is likely to continue at the upper limit at 147.35. In the broader perspective, the decline is likely to resume. The sequence of decreasing relative highs and lows is preserved.

On the four-hour chart, the level of 144.30 is already a support. The last relative minimum was higher than the previous one, and the decline may have been stopped. The pair has been in the lower half of the range since the second half of October. If the resistance was overcome at 145.65, the next target would be the level of 147.35. According to directional movement indicators, the situation is approximately neutral: a slight excess of DM- over DM+, about when the MACD histogram is in the positive zone and the positive slope of the MACD line. The resistance at 145.65 is strong, and when approaching it, the pair slowed down. This does not support the assumption of a breakout of this level now.

- Resistance levels: 145.65; 147.35

- Support levels: 144.30; 142.70

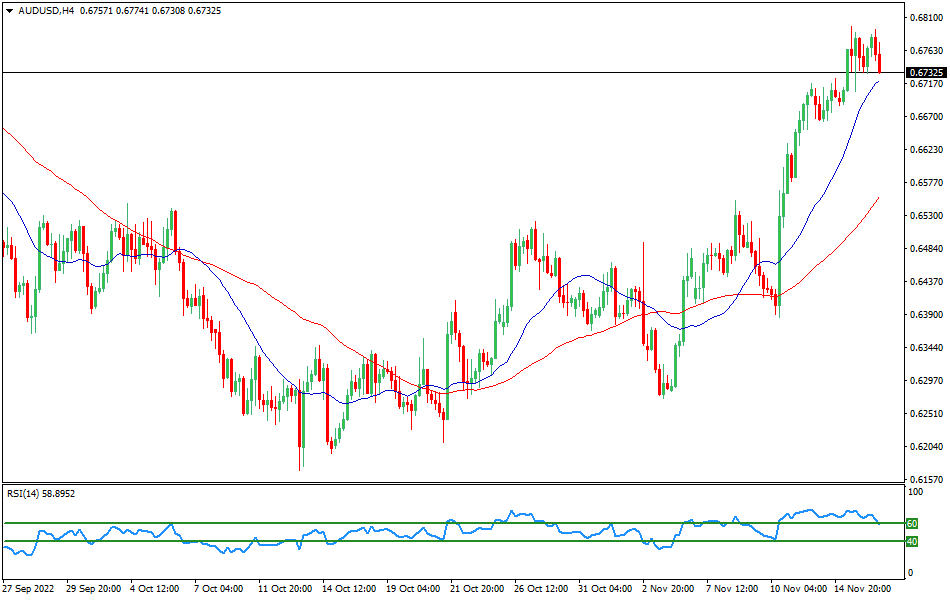

Technical analysis for the AUD/USD currency pair

On the daily chart, the pair continued to grow. It is important to consolidate above the "round" level of 0.6700 (at the lows of June and early September). There are no signs of weakening of the upward movement yet. The trend is strengthening, judging by directional movement indicators: the excess of DM+ over DM- is increasing, the MACD histogram is growing in a positive zone, the MACD line has a positive slope. The probability of a rollback now increases the achievement of the goal of the measured movement equal to the size of the head-shoulders model in late September - early November, it was about 300 points, which, with a neck line of 0.6500, corresponds to 0.6800. However, even if there is a correction, in general, continued growth is now preferable.

On the four-hour chart, the pair may be approaching the beginning of a correction. Growth will slow down, as can be seen by the decrease in the slope of the chart. The formation of candles with upper shadows near the resistance at 0.6800 and candles close to doji rather indicates a weakening of support for growth. A bearish divergence of the pair's highs and the MACD histogram was formed. There were no significant corrections from 0.6400, and the movement of 400 points without correction is large for the pair. With a pullback, strong support may be at the nearest "round" level of 0.6700.

- Resistance level: 0.6800

- Support levels: 0.6760; 0.6700

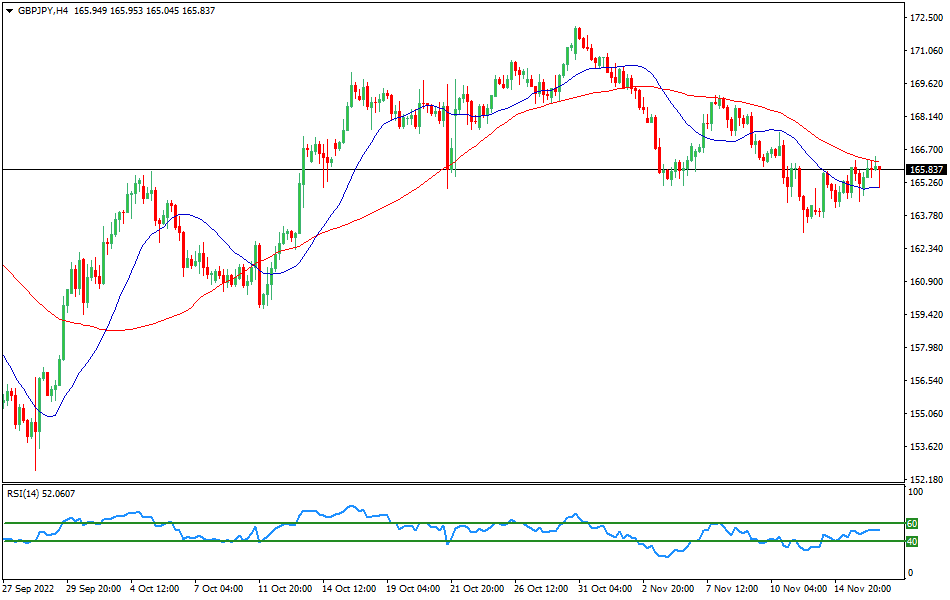

Technical analysis for the GBP/JPY currency pair

On the daily chart, the pair's upward rebound is limited by the resistance level of 165.75. So far, it seems more likely that the decline will continue: the sequence of declines in the relative highs and lows of the pair is not broken, a candle close to a "shooting star" on Tuesday and close (so far) to doji on Wednesday are not characteristic of a reversal. According to directional movement indicators, the trend is downward: DM is above DM+, although at a low ADX level, the MACD histogram is in the negative zone, the MACD line has a negative slope.

On the four-hour chart, testing resistance at 165.75 seems to end with a pullback from this level. The pair is located near the short-term trend line (it can also be considered as the lower boundary of the triangle formed by this line and the level of 165.75). The exit of their triangle downwards corresponds to a broader downward trend and would make the level of 163.80 the nearest target (support on November 11-14).

- Resistance levels: 165.75; 167.60

- Support levels: 164.50; 163.80

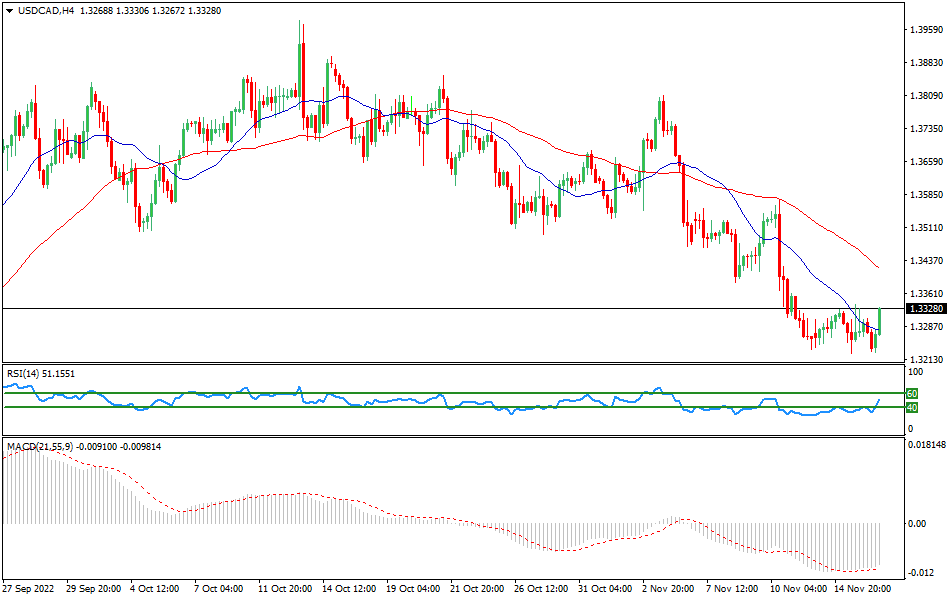

Technical analysis for the USD/CAD currency pair

On the daily chart, the decline continued after a sharp decline from 0.6500 (the lower limit of the range since the end of September). The growth stopped at the level of 1.3200, which is the target of the measured movement, based on the head-shoulders model from the end of September, where the breakthrough of 0.6500 was overcoming the neck line. Thus, the probability of an upward rebound increases here. Support at 1.3200 is also strengthened by the fact that the "round" level, and there were highs in late August and early September. A bullish divergence of the lows of the pair and the MACD histogram was formed. Nevertheless, in general, the continuation of the decline is preferable, since the trend is strong.

On the four-hour chart, after the decline, the pair stabilized above the "round" level of 1.3200. Now it is in the range of 1.3200-1.3300. According to ADX, the decline is a strong trend: the excess of DM- over DM+ is large at a high level of ADX. The probability of an upward rebound from 1.3200 increases the formation of a previously bullish divergence of the pair's lows and the MACD histogram. Further movement is likely to be in the direction of the pair's exit from the range of 1.32-1.33.

- Resistance levels: 1.3300; 1.3400

- Support levels: 1.3200; 1.3145

EURUSD - Technical analysis of the currency pair EUR/USDDuring the Asian trading on Wednesday the EUR/USD currency pair is trading with small increase in quotations, staying within the current support level around 1.0579 with the resistance level around 1.0668. The four-hour chart is progressing just above the exponential moving averages, demonstrating the weak upside potential of this market in the short term.The moving averages with periods of 21 and 55 days continue to move upward, but have significantly slowed down and reduced the divergence, which indicates in favor of a bearish direction of the current market trend in the short term.The technical picture shows a slight advantage for the sellers, as the MACD histogram remains in the area just below its central line, while the indicator of the strength of the current movement RSI is progressing just above the 50 line, confirming the weakness of the downside potential of this market in the short term.Thus, we intend to sell EURUSD today.GBPUSD - Technical analysis of the currency pair GBP/USDWith the opening of trading in Asia on Wednesday, this currency pair is trading with a slight decrease in quotations, remaining within the current support level at 1.2058 and resistance level at 1.2230, where the market chart progresses slightly below the exponential moving averages with a period of 21 and 55 days, demonstrating the preservation of the downward potential of this market in the short term.On the four-hour chart the moving averages continue a barely perceptible downward movement, reducing the divergence, which speaks in favor of the downtrend of this market in the short term.The technical picture also shows the remaining advantage of the sellers, as the MACD histogram remains in the area just below its central line, while the indicator of the strength of the current movement RSI is progressing near the 40 line, confirming the bearish potential of this market in the short-term outlook.Thus, we intend to continue to sell GBPUSD today.USDJPY - Technical analysis of the currency pair USD/JPYDuring the Asian trading session on Wednesday, the currency pair USD/JPY traded with active decrease in quotations, remaining within the current support level at 131.61 and the resistance level around the 133.00 mark.The moving averages with the period of 21 and 55 days continue to move downward, accelerated and increased divergence, demonstrating the strengthening of the bearish trend. The four-hour chart is progressing well below the exponential moving averages, which also indicates in favor of the downward movement of this market in the short term.The technical picture also shows the strengthening of the sellers, increasing the downside potential of this market because the MACD histogram remains in the area well below its center line, and the indicator of the strength of the current movement RSI has fallen to the area of the line 30, promising continuation of the downtrend of this market in the short term.Thus, we intend to sell USDJPY today as well.USDCHF - Technical analysis of the currency pair USD/CHFAt the trades in Asia on Wednesday this currency pair traded with decrease in quotations, remaining within the current support level at 0.9250 and resistance level near 0.9353.On the four-hour chart the moving averages with the period of 21 and 55 days continue their downward movement, keeping the divergence, which speaks in favor of the continuation of the bearish direction of this market today. The four-hour chart of the quotes progresses below the exponential moving averages, which also indicates the descending trend of this market in the short term.The technical picture shows the advantage of the sellers, because the MACD histogram has entered the area just below its central line, and the indicator of the strength of the current movement RSI remains near the 40 line, confirming the continuation of the descending trend of this market in the short-term outlook.Thus, we intend to sell the USDCHF today.

EURUSD - Technical analysis of the currency pair EUR/USDDuring the Asian trading on Wednesday the EUR/USD currency pair is trading with small increase in quotations, staying within the current support level around 1.0579 with the resistance level around 1.0668. The four-hour chart is progressing just above the exponential moving averages, demonstrating the weak upside potential of this market in the short term.The moving averages with periods of 21 and 55 days continue to move upward, but have significantly slowed down and reduced the divergence, which indicates in favor of a bearish direction of the current market trend in the short term.The technical picture shows a slight advantage for the sellers, as the MACD histogram remains in the area just below its central line, while the indicator of the strength of the current movement RSI is progressing just above the 50 line, confirming the weakness of the downside potential of this market in the short term.Thus, we intend to sell EURUSD today.GBPUSD - Technical analysis of the currency pair GBP/USDWith the opening of trading in Asia on Wednesday, this currency pair is trading with a slight decrease in quotations, remaining within the current support level at 1.2058 and resistance level at 1.2230, where the market chart progresses slightly below the exponential moving averages with a period of 21 and 55 days, demonstrating the preservation of the downward potential of this market in the short term.On the four-hour chart the moving averages continue a barely perceptible downward movement, reducing the divergence, which speaks in favor of the downtrend of this market in the short term.The technical picture also shows the remaining advantage of the sellers, as the MACD histogram remains in the area just below its central line, while the indicator of the strength of the current movement RSI is progressing near the 40 line, confirming the bearish potential of this market in the short-term outlook.Thus, we intend to continue to sell GBPUSD today.USDJPY - Technical analysis of the currency pair USD/JPYDuring the Asian trading session on Wednesday, the currency pair USD/JPY traded with active decrease in quotations, remaining within the current support level at 131.61 and the resistance level around the 133.00 mark.The moving averages with the period of 21 and 55 days continue to move downward, accelerated and increased divergence, demonstrating the strengthening of the bearish trend. The four-hour chart is progressing well below the exponential moving averages, which also indicates in favor of the downward movement of this market in the short term.The technical picture also shows the strengthening of the sellers, increasing the downside potential of this market because the MACD histogram remains in the area well below its center line, and the indicator of the strength of the current movement RSI has fallen to the area of the line 30, promising continuation of the downtrend of this market in the short term.Thus, we intend to sell USDJPY today as well.USDCHF - Technical analysis of the currency pair USD/CHFAt the trades in Asia on Wednesday this currency pair traded with decrease in quotations, remaining within the current support level at 0.9250 and resistance level near 0.9353.On the four-hour chart the moving averages with the period of 21 and 55 days continue their downward movement, keeping the divergence, which speaks in favor of the continuation of the bearish direction of this market today. The four-hour chart of the quotes progresses below the exponential moving averages, which also indicates the descending trend of this market in the short term.The technical picture shows the advantage of the sellers, because the MACD histogram has entered the area just below its central line, and the indicator of the strength of the current movement RSI remains near the 40 line, confirming the continuation of the descending trend of this market in the short-term outlook.Thus, we intend to sell the USDCHF today.  EURUSD - Technical analysis for the currency pair EUR/USDAt the trading in Asia on Monday the currency pair EURUSD is trading with increasing quotes, staying within the current support level around 1.0535 with the resistance level around 1.0656. The four-hour chart is progressing slightly above the exponential moving averages, demonstrating the upside potential of this market in the short term.The moving averages with periods of 21 and 55 days continue to move upward, maintaining the divergence, which indicates in favor of a bullish direction of the current market trend in the short term.The technical picture shows the buyers losing the advantage, as the MACD histogram has fallen to the area just below its central line, while the indicator of the strength of the current movement RSI stays just above the 50 line, confirming a slight bullish potential of this market in the short term.Thus, we intend to buy this trading instrument today.GBPUSD - Technical analysis for the currency pair GBP/USDWith the opening of trading in Asia on Monday, this currency pair is trading with a slight increase in quotations, remaining within the current support level at 1.2119 and resistance level at 1.2233, where the market chart progresses between the exponential moving averages with periods of 21 and 55 days, demonstrating the fading bullish potential of this market in the short term.On the four-hour chart, the moving averages continue to turn downward, reducing the divergence, which speaks in favor of the emergence of a downtrend in this market in the short term.The technical picture also demonstrates the loss of the buyers' advantage, as the MACD histogram remains in the area below its center line, and the indicator of the strength of the current movement RSI remains near the 40 line, confirming the bearish potential in this market in the short term.Thus, we intend to sell this trading instrument today.USDJPY - Technical analysis for the currency pair USD/JPYDuring the Asian trading session on Monday, the currency pair USDJPY traded with a slight decrease in quotations, remaining within the current support level at 135.26 and the resistance level around 136.74.The moving averages with the period of 21 and 55 days continue to move downward, maintaining a noticeable divergence and demonstrating the emergence of a bearish trend. The four-hour chart is progressing below the exponential moving averages, which also indicates in favor of the downward movement of this market in the short term.The technical picture shows a slight strengthening of the sellers, but the buyers retain their potential because the MACD histogram remains in the area above its center line, and the strength indicator of the current movement RSI remains near the 40 line, promising strengthening of the downtrend in this market in the short term.Thus, we intend to sell this trading instrument only if the support line is broken.USDCHF - Technical analysis for the currency pair USD/CHFAt the trading in Asia on Monday this currency pair is trading with decrease in quotations, staying within the current support level at 0.9262 and resistance level near 0.9351.On the four-hour chart the moving averages with the period of 21 and 55 days continue their downward movement, keeping the divergence, which speaks in favor of the withering bearish direction of this market today. The four-hour chart of the quotes progresses between the exponential moving averages, which is the evidence of weakening of the descending trend of this market in the short term.The technical picture demonstrates the buyers' advantage, as the MACD histogram went to the area just above its center line, and the indicator of the strength of the current movement RSI is progressing near the 50 line, confirming the instability of the current market trend in the short-term outlook.Thus, we intend to stay out of this market today.

EURUSD - Technical analysis for the currency pair EUR/USDAt the trading in Asia on Monday the currency pair EURUSD is trading with increasing quotes, staying within the current support level around 1.0535 with the resistance level around 1.0656. The four-hour chart is progressing slightly above the exponential moving averages, demonstrating the upside potential of this market in the short term.The moving averages with periods of 21 and 55 days continue to move upward, maintaining the divergence, which indicates in favor of a bullish direction of the current market trend in the short term.The technical picture shows the buyers losing the advantage, as the MACD histogram has fallen to the area just below its central line, while the indicator of the strength of the current movement RSI stays just above the 50 line, confirming a slight bullish potential of this market in the short term.Thus, we intend to buy this trading instrument today.GBPUSD - Technical analysis for the currency pair GBP/USDWith the opening of trading in Asia on Monday, this currency pair is trading with a slight increase in quotations, remaining within the current support level at 1.2119 and resistance level at 1.2233, where the market chart progresses between the exponential moving averages with periods of 21 and 55 days, demonstrating the fading bullish potential of this market in the short term.On the four-hour chart, the moving averages continue to turn downward, reducing the divergence, which speaks in favor of the emergence of a downtrend in this market in the short term.The technical picture also demonstrates the loss of the buyers' advantage, as the MACD histogram remains in the area below its center line, and the indicator of the strength of the current movement RSI remains near the 40 line, confirming the bearish potential in this market in the short term.Thus, we intend to sell this trading instrument today.USDJPY - Technical analysis for the currency pair USD/JPYDuring the Asian trading session on Monday, the currency pair USDJPY traded with a slight decrease in quotations, remaining within the current support level at 135.26 and the resistance level around 136.74.The moving averages with the period of 21 and 55 days continue to move downward, maintaining a noticeable divergence and demonstrating the emergence of a bearish trend. The four-hour chart is progressing below the exponential moving averages, which also indicates in favor of the downward movement of this market in the short term.The technical picture shows a slight strengthening of the sellers, but the buyers retain their potential because the MACD histogram remains in the area above its center line, and the strength indicator of the current movement RSI remains near the 40 line, promising strengthening of the downtrend in this market in the short term.Thus, we intend to sell this trading instrument only if the support line is broken.USDCHF - Technical analysis for the currency pair USD/CHFAt the trading in Asia on Monday this currency pair is trading with decrease in quotations, staying within the current support level at 0.9262 and resistance level near 0.9351.On the four-hour chart the moving averages with the period of 21 and 55 days continue their downward movement, keeping the divergence, which speaks in favor of the withering bearish direction of this market today. The four-hour chart of the quotes progresses between the exponential moving averages, which is the evidence of weakening of the descending trend of this market in the short term.The technical picture demonstrates the buyers' advantage, as the MACD histogram went to the area just above its center line, and the indicator of the strength of the current movement RSI is progressing near the 50 line, confirming the instability of the current market trend in the short-term outlook.Thus, we intend to stay out of this market today.  USDCAD SignalsUSD/CAD is trading in an uptrend on the 4-hour chart. It shows that the USDCAD is trading above the moving average with a period of 55 on the 4-hour chart (the level of 1.3380), which generally contributes to the price increase in the short term. I recommend to buy on this pair on the basis of the existing wave pattern.The signal to open a long position will be a breakdown of the resistance at 1.3417 with the aim to go higher to the next resistance at 1.3497 and in case of its breakdown to 1.3574. I recommend to place a stop-loss at 1.3290.The signal to open a short position will be a breakdown of support at 1.3301, with the aim to go down to 1.3227, if it penetrates 1.3149. I recommend to place a stop-loss on this strategy at 1.3455.Taking into account that the moving average and the positioning of the technical figure boundaries move over time, it is necessary to make corrections in their positions on the 4-hour chart.EURUSD SignalsIn the 1-hour chart the pair EURUSD is moving in an uptrend. I recommend to open buy positions in case of breakdown of the resistance level 1.0430, with the aim to go higher to the next resistance at the levels 1.0458-1.0488. It is advisable to set a stop below the level of 1.0370.I recommend opening short sell positions after breakdown of the support level 1.0343, with the aim to go down to the support level 1.0315-1.0290. Stop above the level of 1.0405.GBPUSD SignalsOn the basis of technical modeling on pair pound/dollar the forecast of the further movement was formed and the average urgent is predisposed to rise.Having analyzed the technical situation I recommend to buy GBP from level 1.2025 and to place pending buy order at the level of 1.1957 with the purpose of increase in the resistance area between 1.2330-1.2428.

USDCAD SignalsUSD/CAD is trading in an uptrend on the 4-hour chart. It shows that the USDCAD is trading above the moving average with a period of 55 on the 4-hour chart (the level of 1.3380), which generally contributes to the price increase in the short term. I recommend to buy on this pair on the basis of the existing wave pattern.The signal to open a long position will be a breakdown of the resistance at 1.3417 with the aim to go higher to the next resistance at 1.3497 and in case of its breakdown to 1.3574. I recommend to place a stop-loss at 1.3290.The signal to open a short position will be a breakdown of support at 1.3301, with the aim to go down to 1.3227, if it penetrates 1.3149. I recommend to place a stop-loss on this strategy at 1.3455.Taking into account that the moving average and the positioning of the technical figure boundaries move over time, it is necessary to make corrections in their positions on the 4-hour chart.EURUSD SignalsIn the 1-hour chart the pair EURUSD is moving in an uptrend. I recommend to open buy positions in case of breakdown of the resistance level 1.0430, with the aim to go higher to the next resistance at the levels 1.0458-1.0488. It is advisable to set a stop below the level of 1.0370.I recommend opening short sell positions after breakdown of the support level 1.0343, with the aim to go down to the support level 1.0315-1.0290. Stop above the level of 1.0405.GBPUSD SignalsOn the basis of technical modeling on pair pound/dollar the forecast of the further movement was formed and the average urgent is predisposed to rise.Having analyzed the technical situation I recommend to buy GBP from level 1.2025 and to place pending buy order at the level of 1.1957 with the purpose of increase in the resistance area between 1.2330-1.2428.  EUR/USD analysisAt the trading on Friday the currency pair EUR/USD is trading with the growth of quotations, staying within the current support level near 1.0296 with the resistance level near 1.0427. The four-hour chart shows growth above the exponential EMA moving averages, demonstrating the upward potential of the EUR/USD pair in the short term.The moving averages with periods of 21 and 55 days continue to move upwards, increasing the divergence, which evidences in favor of a bullish nature of the current market trend of the pair in the short term.The technical picture also shows the strength of the buyers, as MACD histogram remains above its central line, and the indicator of the strength of the current movement RSI is above the 60 line, confirming the bullish potential of the euro-dollar pair in the short term.So we recommend buying in this pair today.GBP/USD analysisSince the opening of the trades on Friday this currency pair has been trading with increasing quotes, remaining within the current support level at 1.1883 and resistance level at 1.2138, where the market chart shows the growth well above the exponential moving averages with the period of 21 and 55 days, demonstrating the bullish potential of this market in the short term.On the four-hour chart the moving averages continue to move upward, increasing the divergence, which speaks in favor of strengthening the uptrend in this market in the short term.The technical analysis also demonstrates the loss of the buyers' advantage, as the MACD histogram returned to the area above its center line, while the RSI strength indicator of the current movement rose above the 70 line, confirming the bullish potential in this market in the short term.Thus, we intend to buy in this currency pair today.USD/JPY analysisDuring the Asian trading session on Friday, the USD/JPY currency pair traded slightly lower, remaining within the current support level at 138.05 and the resistance level around 139.67.The moving averages with the period of 21 and 55 days continue to move downward, increasing the divergence, demonstrating the strengthening of the bearish trend. The four-hour chart is progressing below the exponential moving averages, which indicates in favor of the downward movement of this market in the short term.The technical picture also shows strengthening of the sellers, as the MACD histogram remains in the area well below its center line, and the indicator of the strength of the current movement RSI remains below the 40 line, promising the continuation of the downtrend of this market in the short term.So, we are going to sell this pair today.USD/CHF analysisAt the Friday trading this pair traded with the decrease of quotes, remaining within the limits of the current support level at 0.9385 and the resistance level at 0.9488.On the four-hour chart the moving averages with the period of 21 and 55 days continue their downward movement, moderately increasing divergence, which speaks in favor of the bearish direction of this market today. The four-hour chart of the quotes progresses below the exponential moving averages, which indicates the continuation of the descending trend of this market in the short term.The technical analysis also evidences the advantage of the sellers, because MACD histogram remains in the area just below its central line, the indicator of the strength of the current movement RSI is fixed below the 40 line, confirming the stability of the downtrend of this market in the short-term outlook.Thus, we intend to sell in this currency pair today.

EUR/USD analysisAt the trading on Friday the currency pair EUR/USD is trading with the growth of quotations, staying within the current support level near 1.0296 with the resistance level near 1.0427. The four-hour chart shows growth above the exponential EMA moving averages, demonstrating the upward potential of the EUR/USD pair in the short term.The moving averages with periods of 21 and 55 days continue to move upwards, increasing the divergence, which evidences in favor of a bullish nature of the current market trend of the pair in the short term.The technical picture also shows the strength of the buyers, as MACD histogram remains above its central line, and the indicator of the strength of the current movement RSI is above the 60 line, confirming the bullish potential of the euro-dollar pair in the short term.So we recommend buying in this pair today.GBP/USD analysisSince the opening of the trades on Friday this currency pair has been trading with increasing quotes, remaining within the current support level at 1.1883 and resistance level at 1.2138, where the market chart shows the growth well above the exponential moving averages with the period of 21 and 55 days, demonstrating the bullish potential of this market in the short term.On the four-hour chart the moving averages continue to move upward, increasing the divergence, which speaks in favor of strengthening the uptrend in this market in the short term.The technical analysis also demonstrates the loss of the buyers' advantage, as the MACD histogram returned to the area above its center line, while the RSI strength indicator of the current movement rose above the 70 line, confirming the bullish potential in this market in the short term.Thus, we intend to buy in this currency pair today.USD/JPY analysisDuring the Asian trading session on Friday, the USD/JPY currency pair traded slightly lower, remaining within the current support level at 138.05 and the resistance level around 139.67.The moving averages with the period of 21 and 55 days continue to move downward, increasing the divergence, demonstrating the strengthening of the bearish trend. The four-hour chart is progressing below the exponential moving averages, which indicates in favor of the downward movement of this market in the short term.The technical picture also shows strengthening of the sellers, as the MACD histogram remains in the area well below its center line, and the indicator of the strength of the current movement RSI remains below the 40 line, promising the continuation of the downtrend of this market in the short term.So, we are going to sell this pair today.USD/CHF analysisAt the Friday trading this pair traded with the decrease of quotes, remaining within the limits of the current support level at 0.9385 and the resistance level at 0.9488.On the four-hour chart the moving averages with the period of 21 and 55 days continue their downward movement, moderately increasing divergence, which speaks in favor of the bearish direction of this market today. The four-hour chart of the quotes progresses below the exponential moving averages, which indicates the continuation of the descending trend of this market in the short term.The technical analysis also evidences the advantage of the sellers, because MACD histogram remains in the area just below its central line, the indicator of the strength of the current movement RSI is fixed below the 40 line, confirming the stability of the downtrend of this market in the short-term outlook.Thus, we intend to sell in this currency pair today.  Technical analysis for the EUR/USD currency pair During Asian trading on Wednesday, the EUR/USD currency pair traded higher in quotes, remaining within the current support level of 1.0272 with a resistance level of 1.0393. The 4-hour chart broke above the exponential moving averages, suggesting the market may be on the upside in the short term. The 21-day and 55-day moving averages have slowed down, but continue to rise and still diverge slightly. This indicates that the current market trend is moving in a bullish direction in the short term. The technical picture also shows a buyer's edge as the MACD histogram rises above its midline and the RSI, a measure of the strength of the current move, rises to the 60 line, indicating bullishness in this market. I'm checking for an opportunity. in the near future. So today I am going to buy this trading product. Technical analysis for the GBP/USD currency pair The pair traded higher at the Asian open on Wednesday, staying within the current 1.1832 support and 1.1926 resistance level, with market charts breaking through the 21-period exponential moving average. And 55 days, which indicates the appearance of bullish potential for this market in the short term. On the 4-hour chart, the moving averages continue to rise and maintain a slight divergence. The technical picture also shows that the buying edge has been lost as the MACD histogram returned to the area just above the midline and the RSI strength indicator for the current move rose to the 60 line. Confirming the bullish potential in the market. in the near future. So today I am going to buy this trading product. Technical analysis for the USD/JPY currency pair The USD/JPY currency pair rose during Asian deals on Wednesday, remaining within the current support level of 140.13 and the resistance level of 142.09. The 21-day and 55-day moving averages slowed down and consolidated to reduce the divergence, indicating an increase in the bullish trend. The 4-hour chart is moving between exponential moving averages, indicating an uptrend for this market in the short term. Technically, as the MACD histogram remains well above its midline and the RSI, a measure of the strength of the current move, remains near the 50 line, promising a continuation of this market uptrend, the chart also shows buying strength. in the short term. So today I am going to buy this trading product. Technical analysis for the USD/CHF currency pair In Asian deals on Wednesday, the currency pair fell, trading around the current support levels of 0.9422 and the resistance level of 0.9560. On the 4-hour chart, the 21-day and 55-day moving averages resumed their decline and maintained a noticeable divergence. This testifies in favor of the bearish direction of this market today. The 4-hour market chart is just below the exponential moving average line, indicating that the market is continuing its downtrend in the short term. Technical images also show seller dominance as the MACD histogram returns to just below its midline and the RSI, an indicator of the current strength of the move, falls to the 40 line, confirming the stability of this downtrend. Short term market. Therefore, we plan to sell this trading product today.

Technical analysis for the EUR/USD currency pair During Asian trading on Wednesday, the EUR/USD currency pair traded higher in quotes, remaining within the current support level of 1.0272 with a resistance level of 1.0393. The 4-hour chart broke above the exponential moving averages, suggesting the market may be on the upside in the short term. The 21-day and 55-day moving averages have slowed down, but continue to rise and still diverge slightly. This indicates that the current market trend is moving in a bullish direction in the short term. The technical picture also shows a buyer's edge as the MACD histogram rises above its midline and the RSI, a measure of the strength of the current move, rises to the 60 line, indicating bullishness in this market. I'm checking for an opportunity. in the near future. So today I am going to buy this trading product. Technical analysis for the GBP/USD currency pair The pair traded higher at the Asian open on Wednesday, staying within the current 1.1832 support and 1.1926 resistance level, with market charts breaking through the 21-period exponential moving average. And 55 days, which indicates the appearance of bullish potential for this market in the short term. On the 4-hour chart, the moving averages continue to rise and maintain a slight divergence. The technical picture also shows that the buying edge has been lost as the MACD histogram returned to the area just above the midline and the RSI strength indicator for the current move rose to the 60 line. Confirming the bullish potential in the market. in the near future. So today I am going to buy this trading product. Technical analysis for the USD/JPY currency pair The USD/JPY currency pair rose during Asian deals on Wednesday, remaining within the current support level of 140.13 and the resistance level of 142.09. The 21-day and 55-day moving averages slowed down and consolidated to reduce the divergence, indicating an increase in the bullish trend. The 4-hour chart is moving between exponential moving averages, indicating an uptrend for this market in the short term. Technically, as the MACD histogram remains well above its midline and the RSI, a measure of the strength of the current move, remains near the 50 line, promising a continuation of this market uptrend, the chart also shows buying strength. in the short term. So today I am going to buy this trading product. Technical analysis for the USD/CHF currency pair In Asian deals on Wednesday, the currency pair fell, trading around the current support levels of 0.9422 and the resistance level of 0.9560. On the 4-hour chart, the 21-day and 55-day moving averages resumed their decline and maintained a noticeable divergence. This testifies in favor of the bearish direction of this market today. The 4-hour market chart is just below the exponential moving average line, indicating that the market is continuing its downtrend in the short term. Technical images also show seller dominance as the MACD histogram returns to just below its midline and the RSI, an indicator of the current strength of the move, falls to the 40 line, confirming the stability of this downtrend. Short term market. Therefore, we plan to sell this trading product today.  EUR/USD - Technical analysis of the currency pair EURUSDAt the trading in Asia on Monday the currency pair EUR/USD is trading with decrease in the quotes, staying within the current support level near 1.0238 with the resistance level near 1.0354. The four-hour chart is progressing just below the exponential moving averages, demonstrating the downside potential of this market in the short term.The moving averages with periods of 21 and 55 days stopped moving upward, slowed down and are ready to turn down, reducing the divergence, which indicates in favor of the bearish direction of the current market trend in the short term.The technical picture also shows the advantage of the sellers, as the MACD histogram remains in the area below its central line, and the indicator of the strength of the current movement RSI has fallen below the 40 line, confirming the bearish potential of this market in the short term.Read more: Using the MACD indicator in forex tradingThus, we intend to sell this trading instrument today.GBP/USD - Technical analysis of the currency pair GBPUSDWith the opening of trading in Asia on Monday, this currency pair has been trading with lower quotes, remaining within the current support level at 1.1782 and resistance level at 1.1912, where the market chart now progresses between the exponential moving averages with periods of 21 and 55 days, demonstrating the strengthening of the bearish potential of this market in the short term.On the four-hour chart the moving averages stopped moving upward, slowed down, but still continue to maintain a marked divergence, which speaks in favor of strengthening the downtrend in this market in the short term.The technical picture also demonstrates the loss of the buyers' advantage, as the MACD histogram has fallen to below its center line, continuing to grow, and the indicator of the strength of the current movement RSI has fallen to the 40 line, confirming the firm potential of the bears in this market in the short term.Thus, we intend to sell this trading instrument today.USD/JPY - Technical analysis of the currency pair USDJPYDuring the Asian trading session on Monday, the currency pair USD/JPY traded with a slight increase in quotations, remaining within the current support level at 139.65 and the resistance level around 140.86.The moving averages with the period of 21 and 55 days continue to move downward, but significantly slowed down and reduced the divergence, demonstrating the strengthening of the bullish trend. The four-hour chart progresses between the exponential moving averages, which indicates in favor of an upward movement of this market in the short term.The technical picture also shows strengthening of the buyers, as the MACD histogram remains in the area above its center line and keeps growing, and the indicator of the strength of the current movement RSI rose to the 60 line, promising the continuation of the upward trend of this market in the short term.Thus, we intend to buy this trading instrument today.USD/CHF - Technical analysis of currency pair USDCHFAt the trading in Asia on Monday this currency pair is trading with increasing of quotes, remaining within the current support level at 0.9432 and resistance level near 0.9571.On the four-hour chart the moving averages with the periods of 21 and 55 days stopped the downward movement, slowed down and are ready to turn around, which speaks in favor of the bullish direction of this market today. The four-hour chart of the quotes progresses between the exponential moving averages, which indicates the termination of the descending trend of this market in the short term.The technical picture also shows the growing advantage of the buyers, as the MACD histogram returned to the area above its center line, and the indicator of the strength of the current movement RSI is increasing, reaching the 60 line, confirming the ascending trend originating in this market in the short-term outlook.Thus, we intend to buy this trading instrument today.

EUR/USD - Technical analysis of the currency pair EURUSDAt the trading in Asia on Monday the currency pair EUR/USD is trading with decrease in the quotes, staying within the current support level near 1.0238 with the resistance level near 1.0354. The four-hour chart is progressing just below the exponential moving averages, demonstrating the downside potential of this market in the short term.The moving averages with periods of 21 and 55 days stopped moving upward, slowed down and are ready to turn down, reducing the divergence, which indicates in favor of the bearish direction of the current market trend in the short term.The technical picture also shows the advantage of the sellers, as the MACD histogram remains in the area below its central line, and the indicator of the strength of the current movement RSI has fallen below the 40 line, confirming the bearish potential of this market in the short term.Read more: Using the MACD indicator in forex tradingThus, we intend to sell this trading instrument today.GBP/USD - Technical analysis of the currency pair GBPUSDWith the opening of trading in Asia on Monday, this currency pair has been trading with lower quotes, remaining within the current support level at 1.1782 and resistance level at 1.1912, where the market chart now progresses between the exponential moving averages with periods of 21 and 55 days, demonstrating the strengthening of the bearish potential of this market in the short term.On the four-hour chart the moving averages stopped moving upward, slowed down, but still continue to maintain a marked divergence, which speaks in favor of strengthening the downtrend in this market in the short term.The technical picture also demonstrates the loss of the buyers' advantage, as the MACD histogram has fallen to below its center line, continuing to grow, and the indicator of the strength of the current movement RSI has fallen to the 40 line, confirming the firm potential of the bears in this market in the short term.Thus, we intend to sell this trading instrument today.USD/JPY - Technical analysis of the currency pair USDJPYDuring the Asian trading session on Monday, the currency pair USD/JPY traded with a slight increase in quotations, remaining within the current support level at 139.65 and the resistance level around 140.86.The moving averages with the period of 21 and 55 days continue to move downward, but significantly slowed down and reduced the divergence, demonstrating the strengthening of the bullish trend. The four-hour chart progresses between the exponential moving averages, which indicates in favor of an upward movement of this market in the short term.The technical picture also shows strengthening of the buyers, as the MACD histogram remains in the area above its center line and keeps growing, and the indicator of the strength of the current movement RSI rose to the 60 line, promising the continuation of the upward trend of this market in the short term.Thus, we intend to buy this trading instrument today.USD/CHF - Technical analysis of currency pair USDCHFAt the trading in Asia on Monday this currency pair is trading with increasing of quotes, remaining within the current support level at 0.9432 and resistance level near 0.9571.On the four-hour chart the moving averages with the periods of 21 and 55 days stopped the downward movement, slowed down and are ready to turn around, which speaks in favor of the bullish direction of this market today. The four-hour chart of the quotes progresses between the exponential moving averages, which indicates the termination of the descending trend of this market in the short term.The technical picture also shows the growing advantage of the buyers, as the MACD histogram returned to the area above its center line, and the indicator of the strength of the current movement RSI is increasing, reaching the 60 line, confirming the ascending trend originating in this market in the short-term outlook.Thus, we intend to buy this trading instrument today.  Technical analysis for the USD/CHF currency pairAt the Asian auction on Thursday, this currency pair is trading with a decrease in quotations, remaining within the current support level at 0.9431 and the resistance level around 0.9557.On the four-hour chart, the moving averages with a period of 21 and 55 days continue to move down, accelerated and increase a significant discrepancy, which speaks in favor of the bearish orientation of this market today. The four-hour chart of quotations progresses below exponential moving averages, which is also evidence of a downward trend in the market in the short term.The technical picture also demonstrates the sellers' advantage, since the MACD histogram remains in the area below its central line, and the strength indicator of the current RSI movement has fixed below the 40 line, confirming the continuation of the downward trend of this market in the short term and the oversold nature of this trading instrument.Read more: USD/CHF: forex signals, online trading forecasts for today, characteristics & featuresTechnical analysis for the USD/JPY currency pairDuring the Asian trading session on Thursday, the USD/JPY currency pair is trading with an increase in quotations, remaining within the current support level at 138.76 and the resistance level around the 140.68 mark.Moving averages with a period of 21 and 55 days continue to move down, slowed down slightly and increase the divergence, demonstrating the strengthening of the bears' position. The four-hour chart progresses below exponential moving averages, which indicates in favor of a downward movement of this market in the short term.The technical picture also demonstrates the strengthening of sellers, as the MACD histogram remains in the area below its central line, and the strength indicator of the current RSI movement has fallen below the 40 line, promising the continuation of the downward trend of this market in the short term.Thus, we intend to sell this trading instrument today.Technical analysis for the GBP/USD currency pairWith the opening of trading in Asia on Thursday, this currency pair is trading with an increase in quotations, remaining within the current support level at 1.1833 and the resistance level at 1.1922, where the market chart progresses above exponential moving averages with a period of 21 and 55 days, demonstrating the strengthening of the bullish potential of this market in the short term.On the four-hour chart, the moving averages continue to move up, increasing the divergence, which speaks in favor of strengthening the uptrend in this market in the short term.The technical picture shows the weakening advantage of buyers, as the MACD histogram has fallen below its central line, and the strength indicator of the current RSI movement remains near the 60 line, confirming the remaining potential of bulls in this market in the short term.Thus, we intend to buy this trading instrument today.Technical analysis for the EUR/USD currency pairAt trading in Asia on Thursday, the EUR/USD currency pair is trading with an increase in quotations, remaining within the current support level around 1.0313 with a resistance level around 1.0428. The four-hour chart progresses above exponential moving averages, demonstrating the upward potential of this market in the short term.Moving averages with a period of 21 and 55 days continue to move up, accelerating and increasing the divergence, which indicates in favor of the bullish direction of the current market trend in the short term.The technical picture also demonstrates the advantage of buyers, since the MACD histogram remains in the area slightly above its central line, and the strength indicator of the current RSI movement has consolidated above the 60 line, confirming the bullish potential of this market in the short term.Thus, we intend to buy this trading instrument today.

Technical analysis for the USD/CHF currency pairAt the Asian auction on Thursday, this currency pair is trading with a decrease in quotations, remaining within the current support level at 0.9431 and the resistance level around 0.9557.On the four-hour chart, the moving averages with a period of 21 and 55 days continue to move down, accelerated and increase a significant discrepancy, which speaks in favor of the bearish orientation of this market today. The four-hour chart of quotations progresses below exponential moving averages, which is also evidence of a downward trend in the market in the short term.The technical picture also demonstrates the sellers' advantage, since the MACD histogram remains in the area below its central line, and the strength indicator of the current RSI movement has fixed below the 40 line, confirming the continuation of the downward trend of this market in the short term and the oversold nature of this trading instrument.Read more: USD/CHF: forex signals, online trading forecasts for today, characteristics & featuresTechnical analysis for the USD/JPY currency pairDuring the Asian trading session on Thursday, the USD/JPY currency pair is trading with an increase in quotations, remaining within the current support level at 138.76 and the resistance level around the 140.68 mark.Moving averages with a period of 21 and 55 days continue to move down, slowed down slightly and increase the divergence, demonstrating the strengthening of the bears' position. The four-hour chart progresses below exponential moving averages, which indicates in favor of a downward movement of this market in the short term.The technical picture also demonstrates the strengthening of sellers, as the MACD histogram remains in the area below its central line, and the strength indicator of the current RSI movement has fallen below the 40 line, promising the continuation of the downward trend of this market in the short term.Thus, we intend to sell this trading instrument today.Technical analysis for the GBP/USD currency pairWith the opening of trading in Asia on Thursday, this currency pair is trading with an increase in quotations, remaining within the current support level at 1.1833 and the resistance level at 1.1922, where the market chart progresses above exponential moving averages with a period of 21 and 55 days, demonstrating the strengthening of the bullish potential of this market in the short term.On the four-hour chart, the moving averages continue to move up, increasing the divergence, which speaks in favor of strengthening the uptrend in this market in the short term.The technical picture shows the weakening advantage of buyers, as the MACD histogram has fallen below its central line, and the strength indicator of the current RSI movement remains near the 60 line, confirming the remaining potential of bulls in this market in the short term.Thus, we intend to buy this trading instrument today.Technical analysis for the EUR/USD currency pairAt trading in Asia on Thursday, the EUR/USD currency pair is trading with an increase in quotations, remaining within the current support level around 1.0313 with a resistance level around 1.0428. The four-hour chart progresses above exponential moving averages, demonstrating the upward potential of this market in the short term.Moving averages with a period of 21 and 55 days continue to move up, accelerating and increasing the divergence, which indicates in favor of the bullish direction of the current market trend in the short term.The technical picture also demonstrates the advantage of buyers, since the MACD histogram remains in the area slightly above its central line, and the strength indicator of the current RSI movement has consolidated above the 60 line, confirming the bullish potential of this market in the short term.Thus, we intend to buy this trading instrument today.  At the trading in Asia on Tuesday the currency pair EUR/USD is trading with increasing quotes, staying within the current support level around 1.0271 with the resistance level around 1.0357. The four-hour chart is progressing above the exponential moving averages, demonstrating the upside potential of this market in the short term.EUR/USD - Forex Technical Analysis for the EUR/USD currency pairThe moving averages with periods of 21 and 55 days continue to move upward, accelerating and increasing the divergence, which is evidence in favor of a bullish direction of the current market trend in the short term.The technical picture also shows the advantage of the buyers, as the MACD histogram remains in the area just above its central line, and the indicator of the strength of the current movement RSI has consolidated above the 60 line, confirming the bullish potential of this market in the short term.Read more: US national debt: why it is growing all the timeThus, we intend to buy this trading instrument today.

At the trading in Asia on Tuesday the currency pair EUR/USD is trading with increasing quotes, staying within the current support level around 1.0271 with the resistance level around 1.0357. The four-hour chart is progressing above the exponential moving averages, demonstrating the upside potential of this market in the short term.EUR/USD - Forex Technical Analysis for the EUR/USD currency pairThe moving averages with periods of 21 and 55 days continue to move upward, accelerating and increasing the divergence, which is evidence in favor of a bullish direction of the current market trend in the short term.The technical picture also shows the advantage of the buyers, as the MACD histogram remains in the area just above its central line, and the indicator of the strength of the current movement RSI has consolidated above the 60 line, confirming the bullish potential of this market in the short term.Read more: US national debt: why it is growing all the timeThus, we intend to buy this trading instrument today.