The market the day beforeYesterday, the American stock exchanges did not work, because Martin Luther King Day was celebrated in the United States. On January 14, the main stock indexes showed mixed dynamics. The S&P 500 rose 0.08% to 4,663 points, the Dow Jones lost 0.56%, and the Nasdaq rose 0.59%. Energy companies looked better than the market (+2.45%) due to the rally in oil prices. The outsiders were the real estate sector (-1.18%) and finance (-1.01%) against the background of the publication of quarterly reports.Company newsWells Fargo's quarterly results (WFC: +3.7%) exceeded market expectations for EPS due to an increase in lending volume, an increase in interest margin and commission income. In addition, a positive guidance was given on interest income and costs.Boston Beer (SAM: -8.1%) lowered its forecast for fiscal year 2021 for EPS due to increased logistics costs.JPMorgan Chase (JPM: -6.2%) reported EPS better than market-wide expectations, management guidance on NII also beat consensus. However, the spending forecast for 2022 disappointed investors.ExpectationsToday, the market will continue to monitor the reporting season in the financial sector. Despite the fairly strong results of the companies for the fourth quarter, the forecast for expenses for 2022 in most cases may turn out to be a negative factor for quotations.Also in the focus of investors' attention remains the question of how significantly the spread of the omicron strain affects the economy. The number of new infections in the United States is still at record high levels of 800 thousand - 1 million per day. Discussions are resuming about possible pressure on supply chains due to the zero-COVID approach adopted in China, which puts major cities at risk of lockdowns. This can lead to port closures, production disruptions and prolonged transport delays. China's four largest port cities have tightened restrictions in response to the spread of the omicron strain. Although the docks remain open for the time being, the possible closure of ports threatens to cause large delays in the delivery of orders. These delays will spread through supply chains and, ultimately, spur inflation. The pressure on logistics chains in the United States is compounded by a shortage of labor due to the large number of infections with the omicron variant. Against this background, respondents surveyed by the WSJ this month lowered their expectations of GDP growth in the first quarter by more than 1 percentage point, to 3% YoY, compared with their forecast of 4.2% in October.Asian stock exchanges ended trading on January 18 in different directions. China's CSI 300 added 0.97%, Japan's Nikkei 225 fell by 0.27%, Hong Kong's Hang Seng sank by 0.43%. EuroStoxx 50 has been falling by 1.11% since the opening of the session.Risk appetite is uncertain. The yield of treasuries rose to 1.77%. Brent crude futures are quoted at $87.6 per barrel. Gold is trading at $1814.7 per troy ounce.In our opinion, the S&P 500 will hold the upcoming session in the range of 4620-4680 points.MacrostatisticsThe NAHB/Wells Fargo Housing Market Index, which reflects the level of confidence of developers, will be published today. According to the consensus, the January indicator will coincide with the December value of 84 points.Technical pictureOn the eve of the open market index found local support at the level of 4615 points, continuing to move within the ascending channel. The shape of Friday's "candle" indicates the possibility of a short-term reversal to growth. The RSI indicator continues to fluctuate near 50 points. The MACD is not giving signals for a reversal yet.In sightToday, the quarterly report will be published by the second largest US bank by assets, Bank of America (BAC). According to FacstSet's forecast, quarterly EPS will reach $0.77 (+18% YoY), net revenue may reach $22.18 billion (+10% YoY). Based on the results of reports from other key US banks published earlier on Friday, we expect that the main support for BAC's non-interest income will be provided by an increase in remuneration for investment banking services (in particular, consulting and underwriting) due to the high activity of companies in the M&A and IPO market. It is expected that BAC will continue to disband reserves for possible credit losses, as management has already indicated a decrease in the share of net write-offs on loans in October-November. Nevertheless, in subsequent reporting periods, the bank may reduce the release of reserves in the context of tightening credit conditions by the Fed. Also, at the end of the quarter, net interest income is likely to show weak dynamics in the conditions of low interest rates, while the growth in lending volumes is only beginning to recover. A decrease in volatility in financial markets may cause a reduction in income from trading operations. The growth rate of net profit at the end of the quarter is expected to slow down due to an increase in operating expenses against the background of bonuses and employee compensation payments at the end of the year, as well as increased investment in technology.On January 20, the streaming service Netflix (NFLX) will present quarterly results. The consensus forecast predicts revenue growth of 16% YoY, to $7.7 billion, with a decrease in EPS from $1.19 to $0.83. It is expected that the subscriber base will expand by 8.4 million, while management three months ago predicted an increase of 8.5 million. We expect a mixed report from Netflix. In particular, we note the risk that the actual growth of subscribers may be weaker than forecasts. The phenomenal success of the series "The Squid Game", most likely, could not provide a stable trajectory of growth in the fourth quarter. However, given the 16% drop in shares since the publication of the last report, we believe that the market has already taken into account more moderate expectations for expanding the customer base in NFLX quotes. The reaction of investors will also depend on whether the company's forecast for the dynamics of the indicator for the first quarter of 2022 coincides with the consensus of expectations, which assumes an audience growth of 5.8-5.9 million people. In addition, an important aspect of the report will be the issue related to the decision to increase the cost of subscriptions in the United States and Canada by about 11%, which was announced on January 14.On January 21, the largest oilfield services company Schlumberger (SLB) will report for the fourth quarter. We expect strong results from the issuer due to increased global drilling activity. On average, the number of active drilling rigs in the last three months of 2021 was 1,537 units, which is 8.2% higher than in the third quarter. SLB's revenue is expected to increase to $6.1 billion (+10.1% YoY, +4.2% QoQ). At the same time, adjusted net profit may grow to $0.39 per share (+77.3% YoY, +8.3% QoQ). In our opinion, the company's shares are trading above fair value, so positive reporting can be considered as a signal for profit-taking on SLB securities. It is worth noting that the first quarter of the year, as a rule, is weak for oilfield service companies due to a seasonal decrease in drilling ...

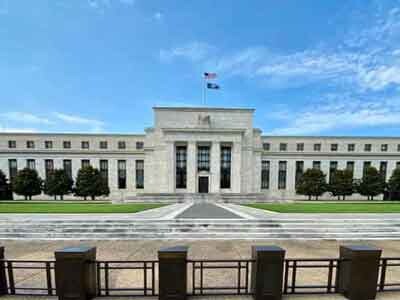

The largest American banks Morgan Stanley, Goldman Sachs, Bank of America and Wells Fargo have increased their dividend payments after they passed the annual stress test from the US Federal Reserve. The regulator noted that the country's main creditors can easily survive a serious economic downturn, thereby providing an opportunity to redistribute excess capital among bank shareholders. The test determines the "stress buffer of capital", that is, an additional financial cushion in excess of the standard, its size comes from possible losses.Morgan Stanley plans to raise its dividend to 77.5 cents per share and a $20 billion buyback program, Goldman Sachs increases its dividend by 25% to $2.5 per share, Bank of America raised its dividend by 5% to 22 cents per share, and Wells Fargo plans to raise its dividend to 30 cents per share.However, this year the increase in dividends has become more restrained than in the past, which was a record for bank capital payments. In addition, JPMorgan & Chase and Citigroup kept their dividends at the same level, since the difficult economic situation may require an increase in capital. Citi is likely to provide an update on its dividend plans as part of its next earnings report on July 15.As part of the annual stress test introduced after the financial crisis of 2007-2009, the Fed assesses how banks' balance sheets will withstand a hypothetical severe economic downturn. The results determine how much capital banks need to operate and how much they can return to ...

The largest American banks Morgan Stanley, Goldman Sachs, Bank of America and Wells Fargo have increased their dividend payments after they passed the annual stress test from the US Federal Reserve. The regulator noted that the country's main creditors can easily survive a serious economic downturn, thereby providing an opportunity to redistribute excess capital among bank shareholders. The test determines the "stress buffer of capital", that is, an additional financial cushion in excess of the standard, its size comes from possible losses.Morgan Stanley plans to raise its dividend to 77.5 cents per share and a $20 billion buyback program, Goldman Sachs increases its dividend by 25% to $2.5 per share, Bank of America raised its dividend by 5% to 22 cents per share, and Wells Fargo plans to raise its dividend to 30 cents per share.However, this year the increase in dividends has become more restrained than in the past, which was a record for bank capital payments. In addition, JPMorgan & Chase and Citigroup kept their dividends at the same level, since the difficult economic situation may require an increase in capital. Citi is likely to provide an update on its dividend plans as part of its next earnings report on July 15.As part of the annual stress test introduced after the financial crisis of 2007-2009, the Fed assesses how banks' balance sheets will withstand a hypothetical severe economic downturn. The results determine how much capital banks need to operate and how much they can return to ...

Despite the fact that large American banks exceeded analysts' expectations for profits, this did not stop the decline of the banking sector.At the moment, reports from 5 of the 6 largest US banks have been released:JPMorgan (JPM);Citigroup (C);Wells Fargo (WFC);Goldman Sachs (GS);Morgan Stanely (MS).The reports are good, why is everything falling?Analysts' expectations were underestimated due to the military actions in Ukraine, so it was not difficult to exceed them. Before the reports were released, it was unclear how much banks would suffer as a result of all this, and the market expected the worst.If you look at the dynamics of profit and compare it with the corresponding quarter of last year, then all banks showed a serious drop. For example, the profits of JP Morgan and Citigroup fell by more than 40%. Wells Fargo showed a decrease of only 20%: it is less focused on the Wall Street divisions, and is focused on retail and commercial customers in the United States.Why did profits decline so sharply?Banks give two reasons:Since the end of 2020, JPMorgan has been releasing its reserves all the time, which has contributed to strong performance. But in the 1st quarter of 2022, the company had to replenish these reserves by almost a billion.The impact of the Russian-Ukrainian conflict. Due to increased volatility and correction in the markets, some banks are experiencing a decrease in profits in the trading and investment banking departments.At the same time, the demand for mortgages has decreased significantly, which also puts pressure on banks.And what about investment banks?JPMorgan, Goldman Sachs and Morgan Stanley have greatly exceeded analysts' expectations in both profit and revenue. This was facilitated by the increased volatility of the markets against the background of Ukraine. In addition, these companies do not need to allocate a large share to reserves due to the specifics of their business. However, they are still under pressure in price due to problems in other segments, for example, in underwriting.What awaits the US banking sector in the near future?Since the beginning of the year, the banking sector has sunk by more than 15%. Investors are afraid of a correction in stock markets due to an increase in the key rate, as well as due to geopolitical problems. Banks are also nervous and raising reserves.Investment banks now look more attractive than their competitors in the sector. But everything depends on further events. The market may react to a serious increase in rates by reducing the value of shares. After all, unlike commodity companies, banks cannot play off all inflationary risks and are highly dependent on the state of the global ...

Despite the fact that large American banks exceeded analysts' expectations for profits, this did not stop the decline of the banking sector.At the moment, reports from 5 of the 6 largest US banks have been released:JPMorgan (JPM);Citigroup (C);Wells Fargo (WFC);Goldman Sachs (GS);Morgan Stanely (MS).The reports are good, why is everything falling?Analysts' expectations were underestimated due to the military actions in Ukraine, so it was not difficult to exceed them. Before the reports were released, it was unclear how much banks would suffer as a result of all this, and the market expected the worst.If you look at the dynamics of profit and compare it with the corresponding quarter of last year, then all banks showed a serious drop. For example, the profits of JP Morgan and Citigroup fell by more than 40%. Wells Fargo showed a decrease of only 20%: it is less focused on the Wall Street divisions, and is focused on retail and commercial customers in the United States.Why did profits decline so sharply?Banks give two reasons:Since the end of 2020, JPMorgan has been releasing its reserves all the time, which has contributed to strong performance. But in the 1st quarter of 2022, the company had to replenish these reserves by almost a billion.The impact of the Russian-Ukrainian conflict. Due to increased volatility and correction in the markets, some banks are experiencing a decrease in profits in the trading and investment banking departments.At the same time, the demand for mortgages has decreased significantly, which also puts pressure on banks.And what about investment banks?JPMorgan, Goldman Sachs and Morgan Stanley have greatly exceeded analysts' expectations in both profit and revenue. This was facilitated by the increased volatility of the markets against the background of Ukraine. In addition, these companies do not need to allocate a large share to reserves due to the specifics of their business. However, they are still under pressure in price due to problems in other segments, for example, in underwriting.What awaits the US banking sector in the near future?Since the beginning of the year, the banking sector has sunk by more than 15%. Investors are afraid of a correction in stock markets due to an increase in the key rate, as well as due to geopolitical problems. Banks are also nervous and raising reserves.Investment banks now look more attractive than their competitors in the sector. But everything depends on further events. The market may react to a serious increase in rates by reducing the value of shares. After all, unlike commodity companies, banks cannot play off all inflationary risks and are highly dependent on the state of the global ...

The market the day beforeThe main American stock indexes ended the trading session on April 13 in the red. The S&P 500 declined by 1.21% to 4,393 points, the Nasdaq fell by 2.14%, the Dow Jones dropped by 0.33%. Only the energy sector (+0.42%) and utilities (+0.01%) remained in a small plus. The risk sectors of IT (-2.45%) and communications (-1.82%) were outsiders.Company newsUS Bancorp (USB: +4.2%) reported better than expected net interest and commission income for the first quarter. There is an increase in lending and a low level of spending.Peloton Interactive (PTON: -4.6%) announced a reduction in prices for simulators and an increase in the subscription price.Wells Fargo (WFC: -4.5%) report for the first quarter fell short of consensus on net interest and commission income. Expenses exceeded expectations. Among the positive aspects of the release are net interest margin, credit growth and credit indicators.We expectThe focus of the investment community remains the Fed's plans to implement a soft landing of the economy. The main task of the regulator is to tighten monetary policy so as to slow down inflation without causing a recession. At Goldman Sachs, the probability of a contraction of the economy in the next two years is estimated at about 35%. Of the 14 cycles of monetary policy tightening in the United States since World War II, 11 have been accompanied by a recession for two years, but only eight of them can be partially attributed to the actions of the Fed. At the same time, the economic downturn has been avoided recently. Taking into account these statistics, investors are in no hurry to actively put the corresponding risks in prices.Market participants continue to monitor corporate reporting for the first quarter. Inflation has a positive effect on corporate revenue, but this factor is not so positive for profitability. Rising energy prices and wages, as well as continuing problems in supply chains provoked by tough anti-trump restrictions in China, may put pressure on corporate profits. As of the end of last week, the FactSet consensus forecast assumed an increase in quarterly EPS of companies from the S&P500 index by 5.74% YoY. The most active increase in profits can be demonstrated by the energy, industrial and manufacturing sectors. EPS declines are expected in the finance and durable goods sectors.APR stock exchanges showed mixed dynamics on April 18. Japan's Nikkei dropped 1.08%, China's CSI 300 declined 0.53%, and Hong Kong's Hang Seng rose 1.58%. There are no auctions on European stock exchanges due to the Easter holidays.The yield of 10-year treasuries rose to 2.83%, reacting to the "hawkish" mood of the Fed. The price of Brent crude futures is trading near $111 per barrel. Gold is rising to $1996 per troy ounce.In our opinion, the S&P 500 will hold the upcoming session in the range of 4350-4400 points.MacrostatisticsNo significant macro statistics are expected to be published today.Sentiment IndexThe sentiment index dropped 1 point to 45.Technical pictureThe S&P 500 is hovering at support at around 4,400 points. While the benchmark has not gone below 4300, there are chances for the formation of the "inverted head and shoulders" pattern, which would be a signal for a strong "bullish" reversal. The RSI remains in the neutral zone, the MACD indicator also indicates the parity of "bulls" and "bears". If buyers do not strengthen their positions, the benchmark will be able to test support in the range of 4300-4350 points in the short term.In sightNetflix (NFLX) will present quarterly results on April 19 after the market closes. The consensus forecast assumes revenue growth of 11% YoY, to $7.94 billion, with a decrease in GAAP EPS from $3.75 to $2.92. The results will be negatively affected by the shutdown of the streaming service in Russia, which could reduce its audience by 1 million subscribers. However, we believe that investors have already taken this fact into account in the quotes. The increase in the number of subscribers is expected to be 2.8 million, despite the fact that three months ago management conservatively predicted an increase in the base by 2.5 million. The reaction of investors to the quarterly release will also depend on how close the calculations of the service's management regarding the dynamics of the audience in the second quarter will be to the consensus, assuming its increase by 2.6 million. By the end of the year, the market-wide expectations include the expansion of the subscriber base by 18 million. We consider these goals achievable even with increased competition. The investment community will pay special attention to management's comments on the prospects for operating marginality due to the acceleration of inflation.On April 20, the quarterly report will be presented by United Airlines Holdings, Inc. (UAL). Revenue of one of the largest US air carriers is expected to decrease by 20% compared to the result of the same period in 2019, to $7.669 billion, with a loss per share of $4.22. The beginning of the year is not the most favorable time for air carriers, so modest quarterly results are embedded in the stock quotes of UAL. The market predicts a reduction in throughput (ASK) by 2% QoQ, to 86,533 million km-seats. We are counting on the neutral reporting of the air carrier. According to the data of analytical and marketing agencies in the field of tourism, as well as the plans and statistics of the air carrier, the volume of tourist and business trips will significantly recover during the year. Their dynamics may partially offset the impact of rising fuel prices on airline results. However, despite significant fluctuations in aviation kerosene prices, the company does not hedge fuel risks, which, along with other factors, will continue to put pressure on profitability.On April 22, Schlumberger (SLB) will publish reports for the first quarter. We expect a significant increase in the results of the largest oilfield services company year-on-year due to increased drilling activity in the world. On average, the number of active drilling rigs in January-March increased by 35% YoY, or by 7.6% QoQ, reaching 1,654 units. Nevertheless, the first quarter is traditionally a weak period for oilfield service companies. The consensus assumes the company's revenue growth by 13.3% YoY with a decrease of 4.9% QoQ, to $5.9 billion. The increase in adjusted net profit is projected at 57% YoY, to $0.33 per share (-19.5% QoQ). Of interest will be the dynamics of the company's expenses against the background of high inflation, as well as the assessment of losses due to the conflict between Russia and ...

The market the day beforeThe main American stock indexes ended the trading session on April 13 in the red. The S&P 500 declined by 1.21% to 4,393 points, the Nasdaq fell by 2.14%, the Dow Jones dropped by 0.33%. Only the energy sector (+0.42%) and utilities (+0.01%) remained in a small plus. The risk sectors of IT (-2.45%) and communications (-1.82%) were outsiders.Company newsUS Bancorp (USB: +4.2%) reported better than expected net interest and commission income for the first quarter. There is an increase in lending and a low level of spending.Peloton Interactive (PTON: -4.6%) announced a reduction in prices for simulators and an increase in the subscription price.Wells Fargo (WFC: -4.5%) report for the first quarter fell short of consensus on net interest and commission income. Expenses exceeded expectations. Among the positive aspects of the release are net interest margin, credit growth and credit indicators.We expectThe focus of the investment community remains the Fed's plans to implement a soft landing of the economy. The main task of the regulator is to tighten monetary policy so as to slow down inflation without causing a recession. At Goldman Sachs, the probability of a contraction of the economy in the next two years is estimated at about 35%. Of the 14 cycles of monetary policy tightening in the United States since World War II, 11 have been accompanied by a recession for two years, but only eight of them can be partially attributed to the actions of the Fed. At the same time, the economic downturn has been avoided recently. Taking into account these statistics, investors are in no hurry to actively put the corresponding risks in prices.Market participants continue to monitor corporate reporting for the first quarter. Inflation has a positive effect on corporate revenue, but this factor is not so positive for profitability. Rising energy prices and wages, as well as continuing problems in supply chains provoked by tough anti-trump restrictions in China, may put pressure on corporate profits. As of the end of last week, the FactSet consensus forecast assumed an increase in quarterly EPS of companies from the S&P500 index by 5.74% YoY. The most active increase in profits can be demonstrated by the energy, industrial and manufacturing sectors. EPS declines are expected in the finance and durable goods sectors.APR stock exchanges showed mixed dynamics on April 18. Japan's Nikkei dropped 1.08%, China's CSI 300 declined 0.53%, and Hong Kong's Hang Seng rose 1.58%. There are no auctions on European stock exchanges due to the Easter holidays.The yield of 10-year treasuries rose to 2.83%, reacting to the "hawkish" mood of the Fed. The price of Brent crude futures is trading near $111 per barrel. Gold is rising to $1996 per troy ounce.In our opinion, the S&P 500 will hold the upcoming session in the range of 4350-4400 points.MacrostatisticsNo significant macro statistics are expected to be published today.Sentiment IndexThe sentiment index dropped 1 point to 45.Technical pictureThe S&P 500 is hovering at support at around 4,400 points. While the benchmark has not gone below 4300, there are chances for the formation of the "inverted head and shoulders" pattern, which would be a signal for a strong "bullish" reversal. The RSI remains in the neutral zone, the MACD indicator also indicates the parity of "bulls" and "bears". If buyers do not strengthen their positions, the benchmark will be able to test support in the range of 4300-4350 points in the short term.In sightNetflix (NFLX) will present quarterly results on April 19 after the market closes. The consensus forecast assumes revenue growth of 11% YoY, to $7.94 billion, with a decrease in GAAP EPS from $3.75 to $2.92. The results will be negatively affected by the shutdown of the streaming service in Russia, which could reduce its audience by 1 million subscribers. However, we believe that investors have already taken this fact into account in the quotes. The increase in the number of subscribers is expected to be 2.8 million, despite the fact that three months ago management conservatively predicted an increase in the base by 2.5 million. The reaction of investors to the quarterly release will also depend on how close the calculations of the service's management regarding the dynamics of the audience in the second quarter will be to the consensus, assuming its increase by 2.6 million. By the end of the year, the market-wide expectations include the expansion of the subscriber base by 18 million. We consider these goals achievable even with increased competition. The investment community will pay special attention to management's comments on the prospects for operating marginality due to the acceleration of inflation.On April 20, the quarterly report will be presented by United Airlines Holdings, Inc. (UAL). Revenue of one of the largest US air carriers is expected to decrease by 20% compared to the result of the same period in 2019, to $7.669 billion, with a loss per share of $4.22. The beginning of the year is not the most favorable time for air carriers, so modest quarterly results are embedded in the stock quotes of UAL. The market predicts a reduction in throughput (ASK) by 2% QoQ, to 86,533 million km-seats. We are counting on the neutral reporting of the air carrier. According to the data of analytical and marketing agencies in the field of tourism, as well as the plans and statistics of the air carrier, the volume of tourist and business trips will significantly recover during the year. Their dynamics may partially offset the impact of rising fuel prices on airline results. However, despite significant fluctuations in aviation kerosene prices, the company does not hedge fuel risks, which, along with other factors, will continue to put pressure on profitability.On April 22, Schlumberger (SLB) will publish reports for the first quarter. We expect a significant increase in the results of the largest oilfield services company year-on-year due to increased drilling activity in the world. On average, the number of active drilling rigs in January-March increased by 35% YoY, or by 7.6% QoQ, reaching 1,654 units. Nevertheless, the first quarter is traditionally a weak period for oilfield service companies. The consensus assumes the company's revenue growth by 13.3% YoY with a decrease of 4.9% QoQ, to $5.9 billion. The increase in adjusted net profit is projected at 57% YoY, to $0.33 per share (-19.5% QoQ). Of interest will be the dynamics of the company's expenses against the background of high inflation, as well as the assessment of losses due to the conflict between Russia and ...

The market the day beforeYesterday, the American stock exchanges did not work, because Martin Luther King Day was celebrated in the United States. On January 14, the main stock indexes showed mixed dynamics. The S&P 500 rose 0.08% to 4,663 points, the Dow Jones lost 0.56%, and the Nasdaq rose 0.59%. Energy companies looked better than the market (+2.45%) due to the rally in oil prices. The outsiders were the real estate sector (-1.18%) and finance (-1.01%) against the background of the publication of quarterly reports.Company newsWells Fargo's quarterly results (WFC: +3.7%) exceeded market expectations for EPS due to an increase in lending volume, an increase in interest margin and commission income. In addition, a positive guidance was given on interest income and costs.Boston Beer (SAM: -8.1%) lowered its forecast for fiscal year 2021 for EPS due to increased logistics costs.JPMorgan Chase (JPM: -6.2%) reported EPS better than market-wide expectations, management guidance on NII also beat consensus. However, the spending forecast for 2022 disappointed investors.ExpectationsToday, the market will continue to monitor the reporting season in the financial sector. Despite the fairly strong results of the companies for the fourth quarter, the forecast for expenses for 2022 in most cases may turn out to be a negative factor for quotations.Also in the focus of investors' attention remains the question of how significantly the spread of the omicron strain affects the economy. The number of new infections in the United States is still at record high levels of 800 thousand - 1 million per day. Discussions are resuming about possible pressure on supply chains due to the zero-COVID approach adopted in China, which puts major cities at risk of lockdowns. This can lead to port closures, production disruptions and prolonged transport delays. China's four largest port cities have tightened restrictions in response to the spread of the omicron strain. Although the docks remain open for the time being, the possible closure of ports threatens to cause large delays in the delivery of orders. These delays will spread through supply chains and, ultimately, spur inflation. The pressure on logistics chains in the United States is compounded by a shortage of labor due to the large number of infections with the omicron variant. Against this background, respondents surveyed by the WSJ this month lowered their expectations of GDP growth in the first quarter by more than 1 percentage point, to 3% YoY, compared with their forecast of 4.2% in October.Asian stock exchanges ended trading on January 18 in different directions. China's CSI 300 added 0.97%, Japan's Nikkei 225 fell by 0.27%, Hong Kong's Hang Seng sank by 0.43%. EuroStoxx 50 has been falling by 1.11% since the opening of the session.Risk appetite is uncertain. The yield of treasuries rose to 1.77%. Brent crude futures are quoted at $87.6 per barrel. Gold is trading at $1814.7 per troy ounce.In our opinion, the S&P 500 will hold the upcoming session in the range of 4620-4680 points.MacrostatisticsThe NAHB/Wells Fargo Housing Market Index, which reflects the level of confidence of developers, will be published today. According to the consensus, the January indicator will coincide with the December value of 84 points.Technical pictureOn the eve of the open market index found local support at the level of 4615 points, continuing to move within the ascending channel. The shape of Friday's "candle" indicates the possibility of a short-term reversal to growth. The RSI indicator continues to fluctuate near 50 points. The MACD is not giving signals for a reversal yet.In sightToday, the quarterly report will be published by the second largest US bank by assets, Bank of America (BAC). According to FacstSet's forecast, quarterly EPS will reach $0.77 (+18% YoY), net revenue may reach $22.18 billion (+10% YoY). Based on the results of reports from other key US banks published earlier on Friday, we expect that the main support for BAC's non-interest income will be provided by an increase in remuneration for investment banking services (in particular, consulting and underwriting) due to the high activity of companies in the M&A and IPO market. It is expected that BAC will continue to disband reserves for possible credit losses, as management has already indicated a decrease in the share of net write-offs on loans in October-November. Nevertheless, in subsequent reporting periods, the bank may reduce the release of reserves in the context of tightening credit conditions by the Fed. Also, at the end of the quarter, net interest income is likely to show weak dynamics in the conditions of low interest rates, while the growth in lending volumes is only beginning to recover. A decrease in volatility in financial markets may cause a reduction in income from trading operations. The growth rate of net profit at the end of the quarter is expected to slow down due to an increase in operating expenses against the background of bonuses and employee compensation payments at the end of the year, as well as increased investment in technology.On January 20, the streaming service Netflix (NFLX) will present quarterly results. The consensus forecast predicts revenue growth of 16% YoY, to $7.7 billion, with a decrease in EPS from $1.19 to $0.83. It is expected that the subscriber base will expand by 8.4 million, while management three months ago predicted an increase of 8.5 million. We expect a mixed report from Netflix. In particular, we note the risk that the actual growth of subscribers may be weaker than forecasts. The phenomenal success of the series "The Squid Game", most likely, could not provide a stable trajectory of growth in the fourth quarter. However, given the 16% drop in shares since the publication of the last report, we believe that the market has already taken into account more moderate expectations for expanding the customer base in NFLX quotes. The reaction of investors will also depend on whether the company's forecast for the dynamics of the indicator for the first quarter of 2022 coincides with the consensus of expectations, which assumes an audience growth of 5.8-5.9 million people. In addition, an important aspect of the report will be the issue related to the decision to increase the cost of subscriptions in the United States and Canada by about 11%, which was announced on January 14.On January 21, the largest oilfield services company Schlumberger (SLB) will report for the fourth quarter. We expect strong results from the issuer due to increased global drilling activity. On average, the number of active drilling rigs in the last three months of 2021 was 1,537 units, which is 8.2% higher than in the third quarter. SLB's revenue is expected to increase to $6.1 billion (+10.1% YoY, +4.2% QoQ). At the same time, adjusted net profit may grow to $0.39 per share (+77.3% YoY, +8.3% QoQ). In our opinion, the company's shares are trading above fair value, so positive reporting can be considered as a signal for profit-taking on SLB securities. It is worth noting that the first quarter of the year, as a rule, is weak for oilfield service companies due to a seasonal decrease in drilling ...

The market the day beforeYesterday, the American stock exchanges did not work, because Martin Luther King Day was celebrated in the United States. On January 14, the main stock indexes showed mixed dynamics. The S&P 500 rose 0.08% to 4,663 points, the Dow Jones lost 0.56%, and the Nasdaq rose 0.59%. Energy companies looked better than the market (+2.45%) due to the rally in oil prices. The outsiders were the real estate sector (-1.18%) and finance (-1.01%) against the background of the publication of quarterly reports.Company newsWells Fargo's quarterly results (WFC: +3.7%) exceeded market expectations for EPS due to an increase in lending volume, an increase in interest margin and commission income. In addition, a positive guidance was given on interest income and costs.Boston Beer (SAM: -8.1%) lowered its forecast for fiscal year 2021 for EPS due to increased logistics costs.JPMorgan Chase (JPM: -6.2%) reported EPS better than market-wide expectations, management guidance on NII also beat consensus. However, the spending forecast for 2022 disappointed investors.ExpectationsToday, the market will continue to monitor the reporting season in the financial sector. Despite the fairly strong results of the companies for the fourth quarter, the forecast for expenses for 2022 in most cases may turn out to be a negative factor for quotations.Also in the focus of investors' attention remains the question of how significantly the spread of the omicron strain affects the economy. The number of new infections in the United States is still at record high levels of 800 thousand - 1 million per day. Discussions are resuming about possible pressure on supply chains due to the zero-COVID approach adopted in China, which puts major cities at risk of lockdowns. This can lead to port closures, production disruptions and prolonged transport delays. China's four largest port cities have tightened restrictions in response to the spread of the omicron strain. Although the docks remain open for the time being, the possible closure of ports threatens to cause large delays in the delivery of orders. These delays will spread through supply chains and, ultimately, spur inflation. The pressure on logistics chains in the United States is compounded by a shortage of labor due to the large number of infections with the omicron variant. Against this background, respondents surveyed by the WSJ this month lowered their expectations of GDP growth in the first quarter by more than 1 percentage point, to 3% YoY, compared with their forecast of 4.2% in October.Asian stock exchanges ended trading on January 18 in different directions. China's CSI 300 added 0.97%, Japan's Nikkei 225 fell by 0.27%, Hong Kong's Hang Seng sank by 0.43%. EuroStoxx 50 has been falling by 1.11% since the opening of the session.Risk appetite is uncertain. The yield of treasuries rose to 1.77%. Brent crude futures are quoted at $87.6 per barrel. Gold is trading at $1814.7 per troy ounce.In our opinion, the S&P 500 will hold the upcoming session in the range of 4620-4680 points.MacrostatisticsThe NAHB/Wells Fargo Housing Market Index, which reflects the level of confidence of developers, will be published today. According to the consensus, the January indicator will coincide with the December value of 84 points.Technical pictureOn the eve of the open market index found local support at the level of 4615 points, continuing to move within the ascending channel. The shape of Friday's "candle" indicates the possibility of a short-term reversal to growth. The RSI indicator continues to fluctuate near 50 points. The MACD is not giving signals for a reversal yet.In sightToday, the quarterly report will be published by the second largest US bank by assets, Bank of America (BAC). According to FacstSet's forecast, quarterly EPS will reach $0.77 (+18% YoY), net revenue may reach $22.18 billion (+10% YoY). Based on the results of reports from other key US banks published earlier on Friday, we expect that the main support for BAC's non-interest income will be provided by an increase in remuneration for investment banking services (in particular, consulting and underwriting) due to the high activity of companies in the M&A and IPO market. It is expected that BAC will continue to disband reserves for possible credit losses, as management has already indicated a decrease in the share of net write-offs on loans in October-November. Nevertheless, in subsequent reporting periods, the bank may reduce the release of reserves in the context of tightening credit conditions by the Fed. Also, at the end of the quarter, net interest income is likely to show weak dynamics in the conditions of low interest rates, while the growth in lending volumes is only beginning to recover. A decrease in volatility in financial markets may cause a reduction in income from trading operations. The growth rate of net profit at the end of the quarter is expected to slow down due to an increase in operating expenses against the background of bonuses and employee compensation payments at the end of the year, as well as increased investment in technology.On January 20, the streaming service Netflix (NFLX) will present quarterly results. The consensus forecast predicts revenue growth of 16% YoY, to $7.7 billion, with a decrease in EPS from $1.19 to $0.83. It is expected that the subscriber base will expand by 8.4 million, while management three months ago predicted an increase of 8.5 million. We expect a mixed report from Netflix. In particular, we note the risk that the actual growth of subscribers may be weaker than forecasts. The phenomenal success of the series "The Squid Game", most likely, could not provide a stable trajectory of growth in the fourth quarter. However, given the 16% drop in shares since the publication of the last report, we believe that the market has already taken into account more moderate expectations for expanding the customer base in NFLX quotes. The reaction of investors will also depend on whether the company's forecast for the dynamics of the indicator for the first quarter of 2022 coincides with the consensus of expectations, which assumes an audience growth of 5.8-5.9 million people. In addition, an important aspect of the report will be the issue related to the decision to increase the cost of subscriptions in the United States and Canada by about 11%, which was announced on January 14.On January 21, the largest oilfield services company Schlumberger (SLB) will report for the fourth quarter. We expect strong results from the issuer due to increased global drilling activity. On average, the number of active drilling rigs in the last three months of 2021 was 1,537 units, which is 8.2% higher than in the third quarter. SLB's revenue is expected to increase to $6.1 billion (+10.1% YoY, +4.2% QoQ). At the same time, adjusted net profit may grow to $0.39 per share (+77.3% YoY, +8.3% QoQ). In our opinion, the company's shares are trading above fair value, so positive reporting can be considered as a signal for profit-taking on SLB securities. It is worth noting that the first quarter of the year, as a rule, is weak for oilfield service companies due to a seasonal decrease in drilling ...

Wells Fargo & Company (WFC), the third largest bank in the United States by assets, reported for the fourth quarter of 2021. Diluted earnings per share of $1.38 exceeded the consensus forecast of $1.11 and exceeded the result for the same period last year ($0.66) twice. Net profit for the quarter reached $5.75 billion, an increase of 86.02% YoY. The credit institution continues to focus on strategic goals, namely on optimizing operational activities by improving risk management processes and simplifying the company's structure through the closure of bank branches and staff reduction. This allowed us to cut operating expenses in the last quarter by 11% YoY, to $13.19 billion.Net revenue in the reporting period increased by 12.8% YoY to $20.85 billion, exceeding the consensus forecast of $18.79 billion. At the end of the full year, revenue amounted to $78.49 billion, showing an increase of 6% compared to 2020. The bank's net interest income decreased by 1% YoY, to $9.26 billion, amid lower asset yields and lower loan balances. As a result, by the end of 2021, the net interest margin fell to 2.05% after 2.28% in 2020. In our opinion, the increase in long-term yields will continue to affect the interest margin in subsequent reporting periods.Non-interest income, in turn, increased by 27% YoY and amounted to $11.59 billion due to the strong results of subsidiaries operating in the field of venture and private equity investments, as well as net profit from the sale of enterprises. Commission income from investment banking services increased by 38% YoY due to higher remuneration for underwriting and consulting services in the field of M&A. The increase in income was also provided by card servicing activities (+14% YoY) and depository services (+10% YoY). At the same time, there is a noticeable decrease in income in the mortgage lending segment (-14% YoY).The Bank continued to release reserves to cover possible losses on loans (amounted to $875 million), guided by the improvement of the economic situation and a decrease in the share of net write-offs on loans from 0.26% in 2020 to 0.19% by the end of 2021, which also indicates an improvement in the solvency of borrowers. As a result, the balance of disbanded reserves amounted to $13.78 million, which is 43% lower than at the end of last year. As of the first quarter, the bank's ability to absorb losses (TLAC) decreased from 25.7% in 2020 to 23.0% at the end of 2021, which is still higher than the norm of 22% of risk-weighted assets. The basic capital adequacy ratio of CET-1 decreased by 2 basis points to 11.4%, which is worse than the metrics of comparable organizations.Overall, Wells Fargo continues to show improved financial results. The percentage of non-performing assets decreased to 0.82%, or $7.32 billion, which is 17.6% lower than at the end of 2020. The issuer has also significantly improved its return on equity (ROE) from 6.6% in 2020 to 12.8% by the end of 2021. In 2022, the bank's financial performance may improve further.We believe that WFC shares retain the potential for growth and recommend them for purchase. In the basic forecast, the target for the WFC paper is $61, while in a "bearish" development of events, the price may adjust to $52. In a bullish scenario, quotes can rise to ...

Wells Fargo & Company (WFC), the third largest bank in the United States by assets, reported for the fourth quarter of 2021. Diluted earnings per share of $1.38 exceeded the consensus forecast of $1.11 and exceeded the result for the same period last year ($0.66) twice. Net profit for the quarter reached $5.75 billion, an increase of 86.02% YoY. The credit institution continues to focus on strategic goals, namely on optimizing operational activities by improving risk management processes and simplifying the company's structure through the closure of bank branches and staff reduction. This allowed us to cut operating expenses in the last quarter by 11% YoY, to $13.19 billion.Net revenue in the reporting period increased by 12.8% YoY to $20.85 billion, exceeding the consensus forecast of $18.79 billion. At the end of the full year, revenue amounted to $78.49 billion, showing an increase of 6% compared to 2020. The bank's net interest income decreased by 1% YoY, to $9.26 billion, amid lower asset yields and lower loan balances. As a result, by the end of 2021, the net interest margin fell to 2.05% after 2.28% in 2020. In our opinion, the increase in long-term yields will continue to affect the interest margin in subsequent reporting periods.Non-interest income, in turn, increased by 27% YoY and amounted to $11.59 billion due to the strong results of subsidiaries operating in the field of venture and private equity investments, as well as net profit from the sale of enterprises. Commission income from investment banking services increased by 38% YoY due to higher remuneration for underwriting and consulting services in the field of M&A. The increase in income was also provided by card servicing activities (+14% YoY) and depository services (+10% YoY). At the same time, there is a noticeable decrease in income in the mortgage lending segment (-14% YoY).The Bank continued to release reserves to cover possible losses on loans (amounted to $875 million), guided by the improvement of the economic situation and a decrease in the share of net write-offs on loans from 0.26% in 2020 to 0.19% by the end of 2021, which also indicates an improvement in the solvency of borrowers. As a result, the balance of disbanded reserves amounted to $13.78 million, which is 43% lower than at the end of last year. As of the first quarter, the bank's ability to absorb losses (TLAC) decreased from 25.7% in 2020 to 23.0% at the end of 2021, which is still higher than the norm of 22% of risk-weighted assets. The basic capital adequacy ratio of CET-1 decreased by 2 basis points to 11.4%, which is worse than the metrics of comparable organizations.Overall, Wells Fargo continues to show improved financial results. The percentage of non-performing assets decreased to 0.82%, or $7.32 billion, which is 17.6% lower than at the end of 2020. The issuer has also significantly improved its return on equity (ROE) from 6.6% in 2020 to 12.8% by the end of 2021. In 2022, the bank's financial performance may improve further.We believe that WFC shares retain the potential for growth and recommend them for purchase. In the basic forecast, the target for the WFC paper is $61, while in a "bearish" development of events, the price may adjust to $52. In a bullish scenario, quotes can rise to ...

After a lot of profit and loss reports, which American bank is the best to invest in? Let's take a look.Choosing the best American bank for investment can be a difficult task. It is necessary to carefully study their balance sheet, to find the organizations with the highest costs and the largest obligations. Sometimes such expenses can be an unavoidable evil. With the growing number of online-only competitor banks seeking to capture market share by appealing to millennials, well-known brands will inevitably seek to actively invest in improving their infrastructure.Currently, there is an opinion that investors are spoiled for choice, if we talk about the best stocks of American banks. After a year complicated by the coronavirus pandemic, the four largest consumer-oriented brands showed steady results in the second quarter of 2021.The Big FourWells Fargo's net profit for the three months to June 30 was $6.04 billion, which is in sharp contrast to a net loss of $3.8 billion for the same period in 2020. However, the bank warned that "low interest rates and moderate demand for loans" are still a concern.Bank of America expressed similar concerns when it presented its latest earnings report. Net profit of $9.2 billion was increased due to the release of $1.6 billion previously held in reserve in case of default of borrowers on their loans. But interest income fell by 6%, partly due to the persistently low base rate set by the US Federal Reserve.Other contenders for the title of the best shares include Citigroup, which also made a profit of $1.1 billion after releasing some of the cash. The bank's CEO Jane Fraser, saying that consumer and corporate confidence is growing, said: "This was observed in all our companies, which was reflected in the indicators of investment banking and stocks, as well as in a noticeable increase in expenses on our credit cards. Although we should be aware of the uneven recovery on a global scale, we are optimistic about the future."And another bank, no less important than the previous ones. This is JPMorgan Chase, whose quarterly net profit was $12 billion. Again, a large role was played here by the issuance of credit reserves in the amount of $3 billion. The bank's chairman and chief executive officer, Jamie Dimon, said that total credit card expenses increased by 45% this quarter and were 22% higher than before the pandemic in the second quarter of 2019. It is not surprising that the main drivers of growth were spending on travel and entertainment.If we put together the results of all four major American banks, the overall picture shows that they collectively received $33 billion in profit, 9 billion of which can be associated with the release of reserve funds. This is $9 billion more than analysts expected.Although the US inflation rate is rising, the mood in Washington suggests that banks will have to contend with near-zero interest rates for some time yet. Federal Reserve Chairman Jerome Powell told a Congressional committee that the central bank does not plan to raise the base rate earlier than 2023. This may become an undesirable obstacle to the profitability of the US banking sector, even if the demand for loans increases.Read more: Causes of inflation and scientific approaches to their studyThe Best Shares of American Banks in 2021Even as net income recovers, data from the Financial Times shows that costs are also rising significantly, as the shares of the largest US banks are trying to fend off the threat from smaller (and possibly more flexible) competitors in the financial technology sector. The total expenses of the "big four" for the last quarter amounted to $6.6 billion, an increase of 10% compared to the same period last year.Technology and marketing are mainly behind this growth. Given how the use of cash has decreased due to the coronavirus pandemic, some banks are now trying to catch up by introducing digital services. In the US, Internet-only companies, including Current, Varo and Chime, sought to attract customers by processing their payments faster, offering elegant smartphone applications and refusing transaction fees and minimal balance balances.In particular, it seems that the monetary assistance to American households has taught the traditional banking sector a lesson: consumers expect speed and will vote with their feet if they do not receive their funds quickly enough. Indeed, a study by Cornerstone Advisors suggests that in the US in December 2020, 15% of millennials had digital bank accounts, compared with 5% at the beginning of the same year.However, JPMorgan, Wells Fargo and Citigroup closed more than 250 branches in the first half of 2021, and more closures are expected. This is due to the confidence that those customers who started using online banking during the blocking will not return to the branches in the near future. It could also free up capital to expand digital offerings, which are quickly becoming the main focus for people opening accounts and applying for loans.Frequently Asked Questions1. Why are bank shares falling?Stocks of the best American banks can sometimes serve as a barometer of the state of the economy and can fall when Wall Street is nervous about the danger of an economic recovery. Despite the steady numbers on macroeconomic indicators in the second quarter, shares of companies such as Citigroup fell due to continuing concerns about interest rates.2. Are bank stocks a good investment?According to CNN Business, currently, the consensus among investment analysts is that it is worth buying shares of Wells Fargo, Bank of America, JPMorgan Chase, and Citigroup. As for the projected growth in stock prices, the average forecast for Citigroup is the most attractive, as it is expected that they will grow by 26.3% in the next 12 months.3. How do bank stocks perform during inflation?Thomas Michaud, CEO and president of the investment bank Keefe, Bruyette&Woods (KBW), recently stated that, in his opinion, "bank stocks are a good place if concerns about inflation continue to ...

After a lot of profit and loss reports, which American bank is the best to invest in? Let's take a look.Choosing the best American bank for investment can be a difficult task. It is necessary to carefully study their balance sheet, to find the organizations with the highest costs and the largest obligations. Sometimes such expenses can be an unavoidable evil. With the growing number of online-only competitor banks seeking to capture market share by appealing to millennials, well-known brands will inevitably seek to actively invest in improving their infrastructure.Currently, there is an opinion that investors are spoiled for choice, if we talk about the best stocks of American banks. After a year complicated by the coronavirus pandemic, the four largest consumer-oriented brands showed steady results in the second quarter of 2021.The Big FourWells Fargo's net profit for the three months to June 30 was $6.04 billion, which is in sharp contrast to a net loss of $3.8 billion for the same period in 2020. However, the bank warned that "low interest rates and moderate demand for loans" are still a concern.Bank of America expressed similar concerns when it presented its latest earnings report. Net profit of $9.2 billion was increased due to the release of $1.6 billion previously held in reserve in case of default of borrowers on their loans. But interest income fell by 6%, partly due to the persistently low base rate set by the US Federal Reserve.Other contenders for the title of the best shares include Citigroup, which also made a profit of $1.1 billion after releasing some of the cash. The bank's CEO Jane Fraser, saying that consumer and corporate confidence is growing, said: "This was observed in all our companies, which was reflected in the indicators of investment banking and stocks, as well as in a noticeable increase in expenses on our credit cards. Although we should be aware of the uneven recovery on a global scale, we are optimistic about the future."And another bank, no less important than the previous ones. This is JPMorgan Chase, whose quarterly net profit was $12 billion. Again, a large role was played here by the issuance of credit reserves in the amount of $3 billion. The bank's chairman and chief executive officer, Jamie Dimon, said that total credit card expenses increased by 45% this quarter and were 22% higher than before the pandemic in the second quarter of 2019. It is not surprising that the main drivers of growth were spending on travel and entertainment.If we put together the results of all four major American banks, the overall picture shows that they collectively received $33 billion in profit, 9 billion of which can be associated with the release of reserve funds. This is $9 billion more than analysts expected.Although the US inflation rate is rising, the mood in Washington suggests that banks will have to contend with near-zero interest rates for some time yet. Federal Reserve Chairman Jerome Powell told a Congressional committee that the central bank does not plan to raise the base rate earlier than 2023. This may become an undesirable obstacle to the profitability of the US banking sector, even if the demand for loans increases.Read more: Causes of inflation and scientific approaches to their studyThe Best Shares of American Banks in 2021Even as net income recovers, data from the Financial Times shows that costs are also rising significantly, as the shares of the largest US banks are trying to fend off the threat from smaller (and possibly more flexible) competitors in the financial technology sector. The total expenses of the "big four" for the last quarter amounted to $6.6 billion, an increase of 10% compared to the same period last year.Technology and marketing are mainly behind this growth. Given how the use of cash has decreased due to the coronavirus pandemic, some banks are now trying to catch up by introducing digital services. In the US, Internet-only companies, including Current, Varo and Chime, sought to attract customers by processing their payments faster, offering elegant smartphone applications and refusing transaction fees and minimal balance balances.In particular, it seems that the monetary assistance to American households has taught the traditional banking sector a lesson: consumers expect speed and will vote with their feet if they do not receive their funds quickly enough. Indeed, a study by Cornerstone Advisors suggests that in the US in December 2020, 15% of millennials had digital bank accounts, compared with 5% at the beginning of the same year.However, JPMorgan, Wells Fargo and Citigroup closed more than 250 branches in the first half of 2021, and more closures are expected. This is due to the confidence that those customers who started using online banking during the blocking will not return to the branches in the near future. It could also free up capital to expand digital offerings, which are quickly becoming the main focus for people opening accounts and applying for loans.Frequently Asked Questions1. Why are bank shares falling?Stocks of the best American banks can sometimes serve as a barometer of the state of the economy and can fall when Wall Street is nervous about the danger of an economic recovery. Despite the steady numbers on macroeconomic indicators in the second quarter, shares of companies such as Citigroup fell due to continuing concerns about interest rates.2. Are bank stocks a good investment?According to CNN Business, currently, the consensus among investment analysts is that it is worth buying shares of Wells Fargo, Bank of America, JPMorgan Chase, and Citigroup. As for the projected growth in stock prices, the average forecast for Citigroup is the most attractive, as it is expected that they will grow by 26.3% in the next 12 months.3. How do bank stocks perform during inflation?Thomas Michaud, CEO and president of the investment bank Keefe, Bruyette&Woods (KBW), recently stated that, in his opinion, "bank stocks are a good place if concerns about inflation continue to ...