Goldman Sachs has presented a new report on the topic of cryptocurrencies, in which it recognized their emergence as a new asset class. During the preparation of the report, the investment bank learned the opinions of companies whose activities are related to the cryptocurrency industry, including Galaxy Digital, Global FX and Chainlaysis, as well as critics, such as Nouriel Roubini.

The authors note that many major cryptocurrencies are unique and rightfully occupy their place in the market. For example, Bitcoin is a high-capitalization currency, XRP is a system for real-time payments, Ethereum is a smart contract platform, BNB is a token for practical use in applications, and Polkadot is a blockchain platform with the ability to interact with various chains. The proprietary characteristics of each of the cryptocurrencies allow them to attract a certain user base, Goldman Sachs adds.

The value of Bitcoin, according to analysts, is built around its use and distribution. Galaxy Digital CEO Mike Novogratz said that the large influx of institutional capital confirms the attractiveness of the cryptocurrency and the high degree of market development.

"The world has cast its vote in recognizing Bitcoin as a good store of value," he added.

Grayscale Investments CEO Michael Sonnenschein supports this view and calls the limited issue of Bitcoin "a means of hedging inflation and currency depreciation". He also noted that cryptocurrencies did not escape the turmoil of the pandemic in 2020, but they recovered faster and outperformed other asset classes.

Nouriel Roubini, a professor of economics at New York University, said that he "does not agree with the idea that something that has no yield, no practical value, or no connection to fundamental economic factors can be considered a means of accumulation or an asset at all." He also questioned the willingness of most institutions to expose themselves to the volatility and risks of cryptocurrencies.

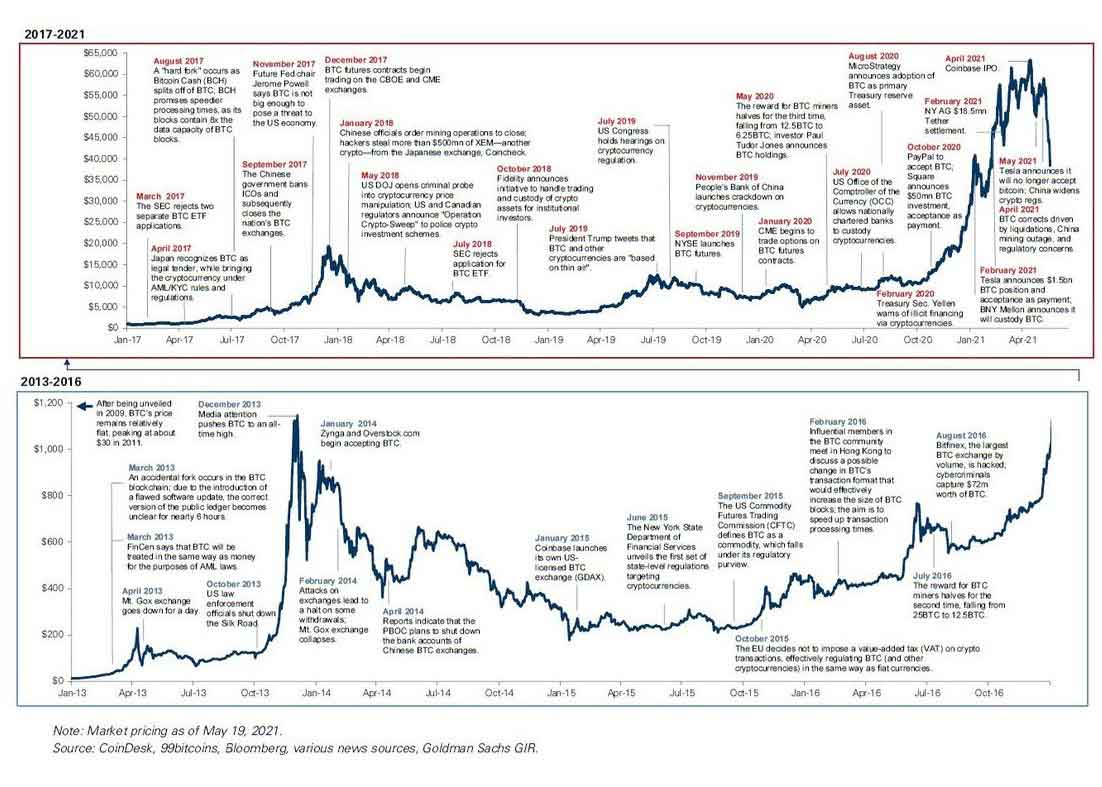

Goldman Sachs analysts provide a chart that illustrates the history of Bitcoin's ups and downs since 2013. Key conclusion: Throughout its existence, bitcoin has always recovered to new highs, no matter how deep the declines were.

The latest report was the exact opposite of a document published by Goldman Sachs a year ago under the headline "Cryptocurrencies, including Bitcoin, are not an asset class."

"We believe that a security whose value growth depends solely on the desire of someone else to buy it more expensive is not suitable as an investment for our clients," they wrote at the time.

Since then, Goldman Sachs has launched its own cryptocurrency trading division and opened up access to Bitcoin derivatives to its clients.

The cryptocurrency has overtaken Binance Coin in terms of capitalization in the digital asset market.Over the past two weeks, the cost of Cardano (ADA) has increased by 80%. On August 20, the ADA price reached a record high of $2.57. This is reported by Bitcoinist with reference to sources. The previous record high was broken in May 2021, when the ADA rose to $2.50.The growth of Cardano takes place against the background of news about the release of a new update of Alonzo Purple with smart contracts. They are necessary to join the DeFi sector of decentralized finance. This will help to make the purchase and sale of tokens automated. This is how Cardano is trying to overtake Ethereum. The release date of Alonzo Purple is scheduled for September 12.The total market capitalization of Cardano exceeds the same indicator of Binance Coin by almost $10 billion, but is inferior to Ethereum by about $300 billion. However, experts are confident that the introduction of smart contracts will reduce this difference in favor of ADA. Now the market capitalization of Cardano is $82.6 billion.

The cryptocurrency has overtaken Binance Coin in terms of capitalization in the digital asset market.Over the past two weeks, the cost of Cardano (ADA) has increased by 80%. On August 20, the ADA price reached a record high of $2.57. This is reported by Bitcoinist with reference to sources. The previous record high was broken in May 2021, when the ADA rose to $2.50.The growth of Cardano takes place against the background of news about the release of a new update of Alonzo Purple with smart contracts. They are necessary to join the DeFi sector of decentralized finance. This will help to make the purchase and sale of tokens automated. This is how Cardano is trying to overtake Ethereum. The release date of Alonzo Purple is scheduled for September 12.The total market capitalization of Cardano exceeds the same indicator of Binance Coin by almost $10 billion, but is inferior to Ethereum by about $300 billion. However, experts are confident that the introduction of smart contracts will reduce this difference in favor of ADA. Now the market capitalization of Cardano is $82.6 billion.  The price stability of Bitcoin does not please the participants of the crypto market at all. Such a lull is perceived as a harbinger of a storm. High volatility of Bitcoin has always been its characteristic feature, and the tendency to rapid growth attracted speculators hoping for a quick profit. Periods of calm and movement in narrow trading ranges often ended with fierce sales. Now is exactly such a moment: Bitcoin is squeezed in a narrow trading corridor with a sequence of declining highs.Approaching the round value at $30K and its subsequent breakdown can trigger an avalanche of sell orders, while buyers this time may not be in a hurry to help the reference cryptocurrency. Many participants of the crypto market are morally ready to see new lows for Bitcoin before new long-term purchases.Bitcoin starts the working week with a slight decrease of 1% and is trading around $32,000. Another alarming sign for the first cryptocurrency was a pause in the growth of the hashrate. Miners are moving after new active actions by the Chinese authorities. And over the course of this process, it becomes clear that it turns out to be much more complex and expensive. The hashrate in the Bitcoin network has not recovered to its peak values and is currently at the levels of the end of October 2019. This should soon be followed by an automatic reduction in complexity. It is generally believed that the price of Bitcoin follows the hashrate/difficulty of mining, so the investment prospects are still deteriorating.The S&P 500 correction may make a negative contribution to the short-term dynamics of the crypto market. In this case, the correlation of the benchmark stock index and Bitcoin may well show its full potential, since similar cautious moods prevail in both markets.Among the positive things for the market, we can note the announcement of PayPal about increasing the weekly limit for the purchase of cryptocurrency from $20K to $100K, as well as the abolition of annual purchase limits. This applies only to American users of the payment system, although, given the fundamental role of the United States in the formation of the cryptocurrency market, such news may well support the market globally.Since the peak values of this year, the total capitalization of the crypto market has fallen by exactly half to $1.27 trillion. Without serious support, we will probably continue to observe a decline in the crypto market up to values that will seem attractive to large investors for opening large positions.

The price stability of Bitcoin does not please the participants of the crypto market at all. Such a lull is perceived as a harbinger of a storm. High volatility of Bitcoin has always been its characteristic feature, and the tendency to rapid growth attracted speculators hoping for a quick profit. Periods of calm and movement in narrow trading ranges often ended with fierce sales. Now is exactly such a moment: Bitcoin is squeezed in a narrow trading corridor with a sequence of declining highs.Approaching the round value at $30K and its subsequent breakdown can trigger an avalanche of sell orders, while buyers this time may not be in a hurry to help the reference cryptocurrency. Many participants of the crypto market are morally ready to see new lows for Bitcoin before new long-term purchases.Bitcoin starts the working week with a slight decrease of 1% and is trading around $32,000. Another alarming sign for the first cryptocurrency was a pause in the growth of the hashrate. Miners are moving after new active actions by the Chinese authorities. And over the course of this process, it becomes clear that it turns out to be much more complex and expensive. The hashrate in the Bitcoin network has not recovered to its peak values and is currently at the levels of the end of October 2019. This should soon be followed by an automatic reduction in complexity. It is generally believed that the price of Bitcoin follows the hashrate/difficulty of mining, so the investment prospects are still deteriorating.The S&P 500 correction may make a negative contribution to the short-term dynamics of the crypto market. In this case, the correlation of the benchmark stock index and Bitcoin may well show its full potential, since similar cautious moods prevail in both markets.Among the positive things for the market, we can note the announcement of PayPal about increasing the weekly limit for the purchase of cryptocurrency from $20K to $100K, as well as the abolition of annual purchase limits. This applies only to American users of the payment system, although, given the fundamental role of the United States in the formation of the cryptocurrency market, such news may well support the market globally.Since the peak values of this year, the total capitalization of the crypto market has fallen by exactly half to $1.27 trillion. Without serious support, we will probably continue to observe a decline in the crypto market up to values that will seem attractive to large investors for opening large positions.  The total number of Coin98 tokens is 1,000,000,000, of which 50,000,000 (5% of the total number of tokens) are allocated for Binance Launchpad.Binance has announced the sale of Coin98 (C98) on its platform to launch an initial token offering. The sale of Coin98 tokens is already the 20th project on Binance Launchpad, which uses the Launchpad subscription format with the recording of user balances in BNB, starting from July 16 at 03:00 to July 23.According to Binance officials, the exchange will determine the maximum amount of money that each user can invest in BNB within seven days based on the calculation of the average BNB rate for the day, already announced by Binance. The expected exchange rate of 1 C98 token is 0.075 USD, although Binance will announce the actual exchange rate only before launching the token.Learn more about Launchpad on BinanceThe sale of new tokens on Launchpad resembles the sale of new tokens that cannot be bought anywhere yet, at low prices. The bottom line is that there is a common BNB pool and a common COIN98 pool. Depending on who throws how much into the BNB pool, the percentage of these C98s will be distributed. The more BNB you have, the more you can buy C98 as a percentage, taking into account everyone who wants and everyone's bid.The total number of C98 tokens is 1,000,000,000, of which 50,000,000 C98 (5% of the total number of tokens) are allocated for Binance Launchpad. The subscription will be open to all eligible users for 4 hours. Users must sign an Agreement to purchase tokens. BNB user accounts will be locked after the user completes the operation, and will be available for trading, withdrawals and transfers only after the final distribution of tokens.The final distribution of tokens will take place on July 23 at 14:00 and the corresponding amount of BNB will be deducted from the amount that was blocked.After the deduction, the C98 and BNB tokens will be transferred to the users ' spot wallets.Read more: Binance: history, features, coins and verificationWhat is Coin98Coin98 is an inter-network liquidity protocol that uses Internet aggregation through innovative solutions such as Multi-chain Engine, Fully automatic liquidity and Space Gate (cross-chain bridge). The platform provides users with access to the DeFi ecosystem, including borrowing protocols, decentralized exchanges, games running on the blockchain, as well as network management (via Snapshot). Users of the platform can also switch from blockchain to blockchain through mobile applications. The protocol provides a complete set of products, including Coin98 Wallet, Coin98 Exchange and Coin98 Bridge, and allows you to easily transfer assets.The C98 token is the platform's own service token for paying for services, as payments for staking, management and unique membership rights.The Coin98 wallet is built as an infrastructure for the future of the crypto world based on a variety of blockchains. It supports more than 20 blockchains, such as Ethereum, Binance Smart Chain, Solana, Polygon, Avalanche, Terra and so on. The Coin98 wallet allows users to store, send, receive, manage crypto assets and connect to dApps on the blockchains that it supports.Coin98 Exchange is a multi-chain liquidity aggregator. It allows users to exchange cryptocurrencies, place bets, borrow, earn cryptocurrency with the best rates and low slippage.Space Gate: An inter-network bridge that allows you to exchange and transfer assets over several networks. Supports token exchange between ERC20, BEP20, SPL tokens, etc. "Due to the fact that the Coin98 wallet contains several chains, it provides a "permanent connection", helping users to access numerous DeFi services through separate block chains without problems and at the same time. Users can also make transactions with tokens with an optimized gas commission and simultaneously manage several digital assets in the Coin98 wallet, " the company wrote on its official website."The C98 token supports multiple tokenomics, serving as both a management and a service token. The C98 tokenomics unites the entire Coin98 ecosystem, " they added.

The total number of Coin98 tokens is 1,000,000,000, of which 50,000,000 (5% of the total number of tokens) are allocated for Binance Launchpad.Binance has announced the sale of Coin98 (C98) on its platform to launch an initial token offering. The sale of Coin98 tokens is already the 20th project on Binance Launchpad, which uses the Launchpad subscription format with the recording of user balances in BNB, starting from July 16 at 03:00 to July 23.According to Binance officials, the exchange will determine the maximum amount of money that each user can invest in BNB within seven days based on the calculation of the average BNB rate for the day, already announced by Binance. The expected exchange rate of 1 C98 token is 0.075 USD, although Binance will announce the actual exchange rate only before launching the token.Learn more about Launchpad on BinanceThe sale of new tokens on Launchpad resembles the sale of new tokens that cannot be bought anywhere yet, at low prices. The bottom line is that there is a common BNB pool and a common COIN98 pool. Depending on who throws how much into the BNB pool, the percentage of these C98s will be distributed. The more BNB you have, the more you can buy C98 as a percentage, taking into account everyone who wants and everyone's bid.The total number of C98 tokens is 1,000,000,000, of which 50,000,000 C98 (5% of the total number of tokens) are allocated for Binance Launchpad. The subscription will be open to all eligible users for 4 hours. Users must sign an Agreement to purchase tokens. BNB user accounts will be locked after the user completes the operation, and will be available for trading, withdrawals and transfers only after the final distribution of tokens.The final distribution of tokens will take place on July 23 at 14:00 and the corresponding amount of BNB will be deducted from the amount that was blocked.After the deduction, the C98 and BNB tokens will be transferred to the users ' spot wallets.Read more: Binance: history, features, coins and verificationWhat is Coin98Coin98 is an inter-network liquidity protocol that uses Internet aggregation through innovative solutions such as Multi-chain Engine, Fully automatic liquidity and Space Gate (cross-chain bridge). The platform provides users with access to the DeFi ecosystem, including borrowing protocols, decentralized exchanges, games running on the blockchain, as well as network management (via Snapshot). Users of the platform can also switch from blockchain to blockchain through mobile applications. The protocol provides a complete set of products, including Coin98 Wallet, Coin98 Exchange and Coin98 Bridge, and allows you to easily transfer assets.The C98 token is the platform's own service token for paying for services, as payments for staking, management and unique membership rights.The Coin98 wallet is built as an infrastructure for the future of the crypto world based on a variety of blockchains. It supports more than 20 blockchains, such as Ethereum, Binance Smart Chain, Solana, Polygon, Avalanche, Terra and so on. The Coin98 wallet allows users to store, send, receive, manage crypto assets and connect to dApps on the blockchains that it supports.Coin98 Exchange is a multi-chain liquidity aggregator. It allows users to exchange cryptocurrencies, place bets, borrow, earn cryptocurrency with the best rates and low slippage.Space Gate: An inter-network bridge that allows you to exchange and transfer assets over several networks. Supports token exchange between ERC20, BEP20, SPL tokens, etc. "Due to the fact that the Coin98 wallet contains several chains, it provides a "permanent connection", helping users to access numerous DeFi services through separate block chains without problems and at the same time. Users can also make transactions with tokens with an optimized gas commission and simultaneously manage several digital assets in the Coin98 wallet, " the company wrote on its official website."The C98 token supports multiple tokenomics, serving as both a management and a service token. The C98 tokenomics unites the entire Coin98 ecosystem, " they added.  On the penultimate day of the working week, the cryptocurrency market shows a moderate decline. Bitcoin has been losing almost 5% over the past day and is trading around $33,500. Thus, the recent price rebound was almost completely compensated. The inability to overcome the threshold $40,000 dollars results in increased bear pressure. As before, the phrase “what does not grow – falls“ is extremely relevant for the crypto market. So far, the scale of the decline is not critical for the market, and a drop up to $30,000 will not mean a reversal of the broad trend. However, if we see a decline to $29,000 and below, this situation may well provoke panic sales. However, it is worth remembering: the more panicky we see sales, the more aggressive the purchases of hunters for discounts will be.The latest episode of the sale on the cryptocurrency market during the last quarter was associated with tough actions of regulators, the emergence of concerns about the possible curtailment of the incentive policy, loud populist statements regarding the non-environmental nature of bitcoin, as well as a decrease in institutional demand for digital currencies. Although sales have somewhat stabilized, the main cryptocurrency remains squeezed in the range between $30K – $40K.The hashrate of the bitcoin network has stabilized after a long period of decline due to the relocation of miners and the shutdown of equipment. Market participants assume that the most difficult moment after the statement of the Chinese authorities about the need for miners to curtail their activities in China has passed. At the moment, the computing power of the network is far from peak values. However, no one doubts that soon the miners will turn back on their equipment and the hashrate will begin to grow. This situation will bring the crypto market a more significant diversification of computing power, the distribution of mining plants around the world, but for China, the loss of control over the computing power of Bitcoin can turn into unpleasant consequences.Nevertheless, the country's authorities should have kept the competitor as close as possible, and not created conditions for even greater global attractiveness of the asset. After all, the more decentralized Bitcoin is, the higher its value in the long term. The relevance and need for Bitcoin is only growing as financial nuts are being tightened in all economies of the world. The world economy has very quickly gone from total globalization to a virtually global trade war. The policy of central banks gave birth to Bitcoin, which has undoubtedly become one of the iconic symbols of the new era and has the potential to turn into a separate economy.

On the penultimate day of the working week, the cryptocurrency market shows a moderate decline. Bitcoin has been losing almost 5% over the past day and is trading around $33,500. Thus, the recent price rebound was almost completely compensated. The inability to overcome the threshold $40,000 dollars results in increased bear pressure. As before, the phrase “what does not grow – falls“ is extremely relevant for the crypto market. So far, the scale of the decline is not critical for the market, and a drop up to $30,000 will not mean a reversal of the broad trend. However, if we see a decline to $29,000 and below, this situation may well provoke panic sales. However, it is worth remembering: the more panicky we see sales, the more aggressive the purchases of hunters for discounts will be.The latest episode of the sale on the cryptocurrency market during the last quarter was associated with tough actions of regulators, the emergence of concerns about the possible curtailment of the incentive policy, loud populist statements regarding the non-environmental nature of bitcoin, as well as a decrease in institutional demand for digital currencies. Although sales have somewhat stabilized, the main cryptocurrency remains squeezed in the range between $30K – $40K.The hashrate of the bitcoin network has stabilized after a long period of decline due to the relocation of miners and the shutdown of equipment. Market participants assume that the most difficult moment after the statement of the Chinese authorities about the need for miners to curtail their activities in China has passed. At the moment, the computing power of the network is far from peak values. However, no one doubts that soon the miners will turn back on their equipment and the hashrate will begin to grow. This situation will bring the crypto market a more significant diversification of computing power, the distribution of mining plants around the world, but for China, the loss of control over the computing power of Bitcoin can turn into unpleasant consequences.Nevertheless, the country's authorities should have kept the competitor as close as possible, and not created conditions for even greater global attractiveness of the asset. After all, the more decentralized Bitcoin is, the higher its value in the long term. The relevance and need for Bitcoin is only growing as financial nuts are being tightened in all economies of the world. The world economy has very quickly gone from total globalization to a virtually global trade war. The policy of central banks gave birth to Bitcoin, which has undoubtedly become one of the iconic symbols of the new era and has the potential to turn into a separate economy.  The Chinese province of Anhui has decided to close all mining farms on its territory due to a lack of electricity. Three years have been allocated for the implementation of the plan. This was a new blow from China to Bitcoin and crypto miners, according to Bloomberg.The decision of the authorities led to a decrease in the value of bitcoin by 4.5 percent to 31.6 thousand dollars. At the time of writing, the bitcoin exchange rate has grown slightly and reached the level of 31.9 thousand dollars.Recently, the Chinese authorities have taken a number of restrictive measures against bitcoin. So, in mid-June, one of the largest provinces of Sichuan banned the mining of cryptocurrencies.At the end of June, the People's Bank of China banned local companies and payment systems from participating in transactions with cryptocurrency. After this message, the bitcoin exchange rate fell below $30,000 for the first time since January, and many miners moved to the United States, Russia and Kazakhstan.The concerns of the Chinese authorities are associated, among other things, with a high level of emissions of harmful substances into the atmosphere due to high electricity consumption during mining. Experts have estimated that the production of cryptocurrencies around the world emits 36.95 megatons of carbon dioxide per year, which corresponds to the level of emissions in an entire country, for example, in New Zealand.

The Chinese province of Anhui has decided to close all mining farms on its territory due to a lack of electricity. Three years have been allocated for the implementation of the plan. This was a new blow from China to Bitcoin and crypto miners, according to Bloomberg.The decision of the authorities led to a decrease in the value of bitcoin by 4.5 percent to 31.6 thousand dollars. At the time of writing, the bitcoin exchange rate has grown slightly and reached the level of 31.9 thousand dollars.Recently, the Chinese authorities have taken a number of restrictive measures against bitcoin. So, in mid-June, one of the largest provinces of Sichuan banned the mining of cryptocurrencies.At the end of June, the People's Bank of China banned local companies and payment systems from participating in transactions with cryptocurrency. After this message, the bitcoin exchange rate fell below $30,000 for the first time since January, and many miners moved to the United States, Russia and Kazakhstan.The concerns of the Chinese authorities are associated, among other things, with a high level of emissions of harmful substances into the atmosphere due to high electricity consumption during mining. Experts have estimated that the production of cryptocurrencies around the world emits 36.95 megatons of carbon dioxide per year, which corresponds to the level of emissions in an entire country, for example, in New Zealand.  The head of CryptoQuant predicted a sharp rise in Bitcoin in the near future. This is due to the outflow of coins from cryptocurrency exchanges. The holders are not ready to sell the leading digital asset right now, but rather keep it on their wallets. We can say that the pressure of sellers is decreasing. A similar situation is happening with the Ethereum cryptocurrency, but Bitcoin has been squeezed within the ascending channel since the end of February, while the ether is steadily moving up. If we suggest that Bitcoin will break the maximum in the near future and postpone the height of the channel up, then the goal of the rise is the level of $85,000 per coin.

The head of CryptoQuant predicted a sharp rise in Bitcoin in the near future. This is due to the outflow of coins from cryptocurrency exchanges. The holders are not ready to sell the leading digital asset right now, but rather keep it on their wallets. We can say that the pressure of sellers is decreasing. A similar situation is happening with the Ethereum cryptocurrency, but Bitcoin has been squeezed within the ascending channel since the end of February, while the ether is steadily moving up. If we suggest that Bitcoin will break the maximum in the near future and postpone the height of the channel up, then the goal of the rise is the level of $85,000 per coin.  The new cryptocurrency Chia (XCH) has fallen in price three times since the start of trading on Monday. According to WEIBO, the token has risen to the second place among the most popular cryptocurrencies.The growing popularity of cryptocurrency Chia may lead to a shortage of hard drives and solid-state drives in the consumer market.The token of the main Chia Network network began trading on the OKEx crypto exchange on May 3. According to CoinMarketCap, in four days, the price of the token fell from the highs of the first day of trading from about $1800 to $600.Earlier, miners caused a shortage of hard drives and solid-state drives in Hong Kong before the launch of the main Chia Network. Already in mid-April, the main stocks of HDD and SSD were sold out, and because of this, their price tripled.The Chia Network blockchain was created by Bram Cohen, an American developer and creator of BitTorrent. He believes that bitcoin and other cryptocurrencies running on the Proof-of-Work (PoW) algorithm use too much electricity.Chia runs on a Proof-of-Space-and-Time algorithm and uses disk space as a transaction validator. Users who provide their own disk space to support the network are rewarded for this.The token is traded on OKEx exchanges, Gate.io, MXC.COM and Bibox. The amount of disk space occupied by the cryptocurrency has currently reached 2.11 exabytes. 457,402 coins were mined out of just over 21 million units.The main network of the project will be launched in March 2021. According to the February 10 white paper, the company raised about $16 million in funding through SAFE agreements. The last $5 million round ended in August 2020. The company is supported by venture funds Andreessen Horowitz, Galaxy Investment Group, DCM Ventures, True Ventures and others.

The new cryptocurrency Chia (XCH) has fallen in price three times since the start of trading on Monday. According to WEIBO, the token has risen to the second place among the most popular cryptocurrencies.The growing popularity of cryptocurrency Chia may lead to a shortage of hard drives and solid-state drives in the consumer market.The token of the main Chia Network network began trading on the OKEx crypto exchange on May 3. According to CoinMarketCap, in four days, the price of the token fell from the highs of the first day of trading from about $1800 to $600.Earlier, miners caused a shortage of hard drives and solid-state drives in Hong Kong before the launch of the main Chia Network. Already in mid-April, the main stocks of HDD and SSD were sold out, and because of this, their price tripled.The Chia Network blockchain was created by Bram Cohen, an American developer and creator of BitTorrent. He believes that bitcoin and other cryptocurrencies running on the Proof-of-Work (PoW) algorithm use too much electricity.Chia runs on a Proof-of-Space-and-Time algorithm and uses disk space as a transaction validator. Users who provide their own disk space to support the network are rewarded for this.The token is traded on OKEx exchanges, Gate.io, MXC.COM and Bibox. The amount of disk space occupied by the cryptocurrency has currently reached 2.11 exabytes. 457,402 coins were mined out of just over 21 million units.The main network of the project will be launched in March 2021. According to the February 10 white paper, the company raised about $16 million in funding through SAFE agreements. The last $5 million round ended in August 2020. The company is supported by venture funds Andreessen Horowitz, Galaxy Investment Group, DCM Ventures, True Ventures and others.  Cryptocurrency XRP surged to three-week highs near $1.75 on Thursday amid an ongoing altcoin rally.In addition, it became known that a former high-ranking official of the US government was appointed to the board of directors of Ripple.Former US Treasurer Rosa Rios has joined Ripple's board of directors. The company also appointed a new financial director (CFO) — the former head of PlayNearMe and Green Dot Christina Campbell.Rios has 30 years of experience in public policy and investment management. In 2009-2016, she served as the Chief Treasurer of the United States under the presidency of Barack Obama."Ripple is one of the best examples of how to legally use cryptocurrency to significantly facilitate payments around the world," Rios said.Campbell previously worked as the CFO of the payment company PayNearMe and held several positions at the California-based fintech company GreenDot.At Ripple (XRP), Campbell will focus on the company's financial strategy, try to accelerate its growth and add value to shareholders.Recall, Ripple's trial with the US Securities and Exchange Commission (SEC) continues. On May 4, the SEC filed a motion against the participation of XRP token holders in the proceedings with Ripple.According to the regulator, the intervention of a third party will delay the trial and require additional resources. Earlier, foreign regulators refused to help the SEC in the case against Ripple.From other news. The Phemex crypto exchange re-launches the XRP token. This re-listing may be the first of many, as marketplaces gain more confidence that Ripple can win in court against the SEC.

Cryptocurrency XRP surged to three-week highs near $1.75 on Thursday amid an ongoing altcoin rally.In addition, it became known that a former high-ranking official of the US government was appointed to the board of directors of Ripple.Former US Treasurer Rosa Rios has joined Ripple's board of directors. The company also appointed a new financial director (CFO) — the former head of PlayNearMe and Green Dot Christina Campbell.Rios has 30 years of experience in public policy and investment management. In 2009-2016, she served as the Chief Treasurer of the United States under the presidency of Barack Obama."Ripple is one of the best examples of how to legally use cryptocurrency to significantly facilitate payments around the world," Rios said.Campbell previously worked as the CFO of the payment company PayNearMe and held several positions at the California-based fintech company GreenDot.At Ripple (XRP), Campbell will focus on the company's financial strategy, try to accelerate its growth and add value to shareholders.Recall, Ripple's trial with the US Securities and Exchange Commission (SEC) continues. On May 4, the SEC filed a motion against the participation of XRP token holders in the proceedings with Ripple.According to the regulator, the intervention of a third party will delay the trial and require additional resources. Earlier, foreign regulators refused to help the SEC in the case against Ripple.From other news. The Phemex crypto exchange re-launches the XRP token. This re-listing may be the first of many, as marketplaces gain more confidence that Ripple can win in court against the SEC.