Learning how to trade in financial markets

Education

PPI index: definition, method of calculation and how to use it

When making decisions about investing in any assets, it is necessary to analyze not only the performance indicators of specific companies, but also the external environment - the economic...

Oct 16, 2022

Read

What affects the price of Bitcoin

Bitcoin is predicted to be the currency of the future. Decentralization, anonymity, deflationary properties - these are the main "trump cards" of this digital currency. But the high...

Oct 15, 2022

Read

Algorithmic trading in financial markets

When the DeepBlue chess supercomputer defeated the reigning world champion Garry Kasparov on May 11, 1997, many realized for the first time that computers are capable of solving many...

Oct 12, 2022

Read

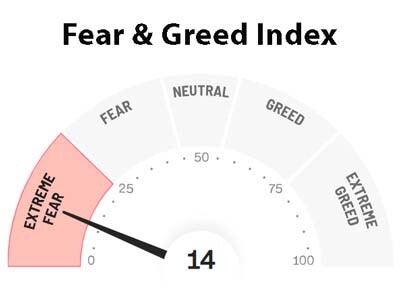

About Fear & Greed Index

"What has always mattered to me is the key factor that moves the stock market. This is not an analysis, statistics or facts,... no, these are human emotions. As soon as people understand...

Oct 02, 2022

Read

Compound Interest in Investing - How it works

The purpose of investing is to generate income. Different trading strategies can be used to achieve this goal. A trading strategy is a complex algorithm of actions that has been practiced...

Sep 18, 2022

Read

What is SWIFT: history of creation, participants and competitors

SWIFT is an international interbank system that allows its participants from different countries to make payments between themselves quickly, safely and for a relatively small fee....

Sep 17, 2022

Read

What's going on with Binance - regulatory pressure and the future of the exchange

Do you trade on the Binance cryptocurrency exchange? Perhaps today it is the TOP-1 platform in the world, but about a year ago the crypto exchange began to have serious problems with...

Sep 17, 2022

Read

The reasons for the mistakes of novice traders

Mistakes of novice traders. A sad conversation about trading.Looking back, I see a very sad picture of the success of traders. Of those with whom I started trading, today there is practically...

Aug 06, 2022

Read

Swing trading - strategy of successful traders

One of the most successful trading strategies that traders use in their trading is swing trading.Today we will try to figure out what this concept is and how to apply it.What is swing...

Aug 06, 2022

Read

How a trader's psychology can defeat his fierce enemies – fears and emotions

I'm not a coward, but I'm afraid. Of course, each of us has our own "butterflies in our heads", but there is something in common that unites us all. These are our fears! They significantly...

Jul 26, 2022

Read

The Libor rate. Is bargaining appropriate?

It was 2012, and nothing foreshadowed trouble. The global crisis of 2008 slowly began to subside. And then, like a bolt from the blue, the LIBOR rate scandal broke out.The British regulator...

Jul 23, 2022

Read

Five principles of healthy indifference in the philosophy of trading

Who are we – traders? What are we doing and what are we doing? Where are we going, and what awaits us ahead?Questions, questions, questions... to which, unfortunately, there are not...

Jul 23, 2022

Read